ProShares has announced the launch of three Exchange-Traded Funds (ETFs) based on XRP futures contracts, following an implicit approval from the U.S. Securities and Exchange Commission (SEC). This move represents a significant shift in the institutional market’s approach to XRP. These funds enhance financial institutions’ interest in the digital asset and pave the way for a potential approval of Spot ETFs in the future.

In the same context, Hashdex, a Brazil-based digital asset management company, has launched the first Spot XRP fund in the Brazilian market. This XRP-backed fund strengthens expectations that this initiative may soon expand into the U.S. market.

Amid these developments, XRP has risen by 2.79%, supported by regulatory momentum and increasing institutional investor interest in digital assets. At the same time, investors are looking forward to the SEC’s approval of U.S.-based XRP Spot ETFs by October 2025. If approved, it could further boost the positive momentum for the cryptocurrency, enabling investors to purchase XRP directly in the U.S. market, potentially leading to substantial investment inflows and a significant increase in its market capitalization.

The Bitcoin Dominance Index is used as a tool to assess Bitcoin’s impact and its share of the overall cryptocurrency market.

Impact of Bitcoin Dominance Index on Bitcoin’s movements:

-

Increase: May indicate that Bitcoin is leading the market, as investors prefer Bitcoin’s relative stability over the higher risks associated with altcoins.

-

Decrease: May suggest a capital shift toward altcoins.

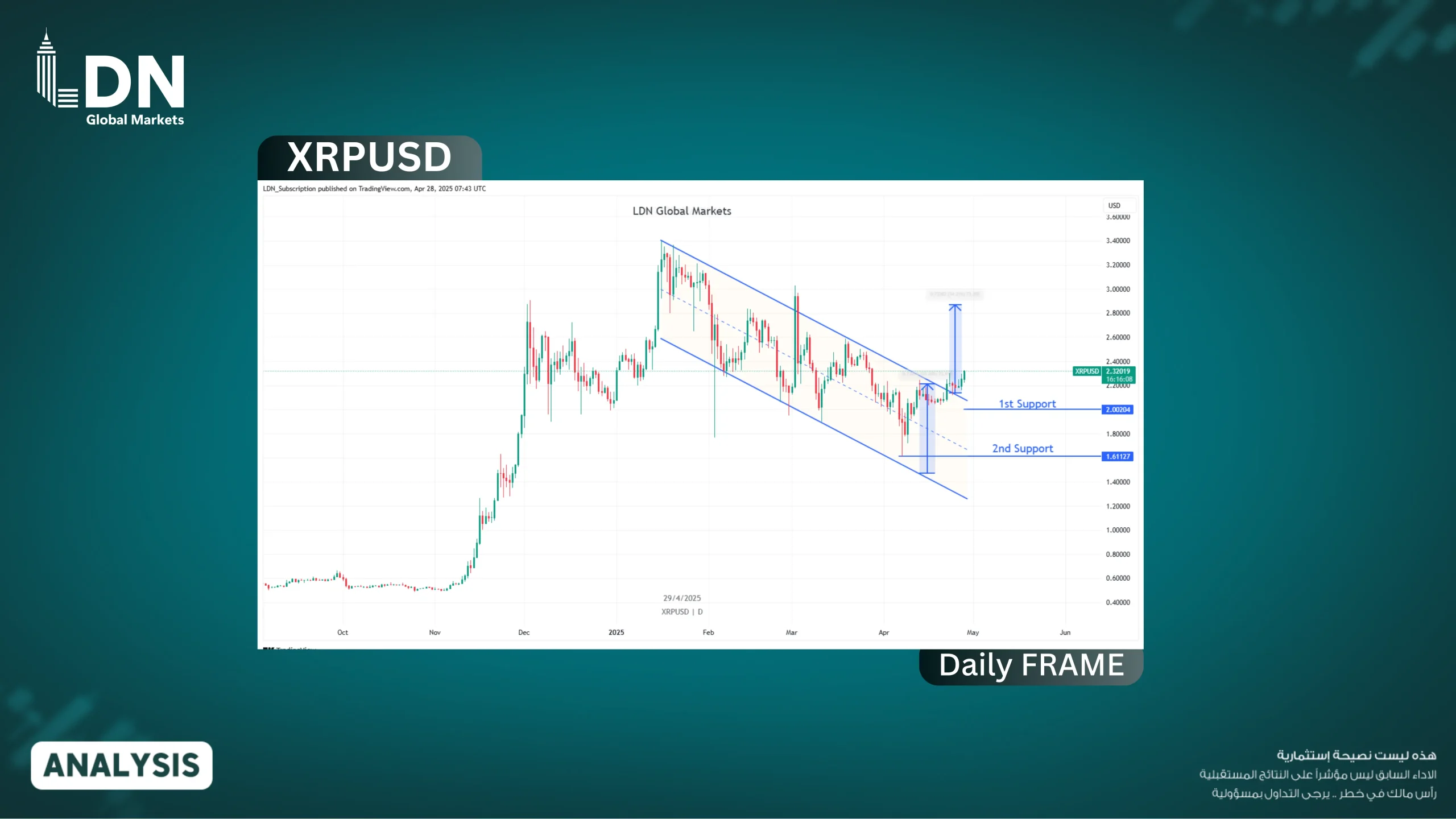

From a technical perspective:

A decline in the Bitcoin Dominance Index is expected in the coming period.