Investors worldwide are closely watching the impact of Donald Trump’s return to the White House on global markets, trade, and international relations. With the start of his second term on January 20, Trump is expected to sign a series of executive orders affecting taxes, tariffs, and other key issues. While U.S. markets will be closed for Martin Luther King Jr. Day, full investor reactions may not materialize until Tuesday.

Potential tariff changes remain a major concern, as similar moves in the past caused notable market volatility. Long-term bond yields have risen, with traders anticipating that Trump’s tax cut plans and tariff impositions will drive inflation and stimulate domestic economic growth. However, concerns about the growing national debt’s impact on the U.S. economy persist.

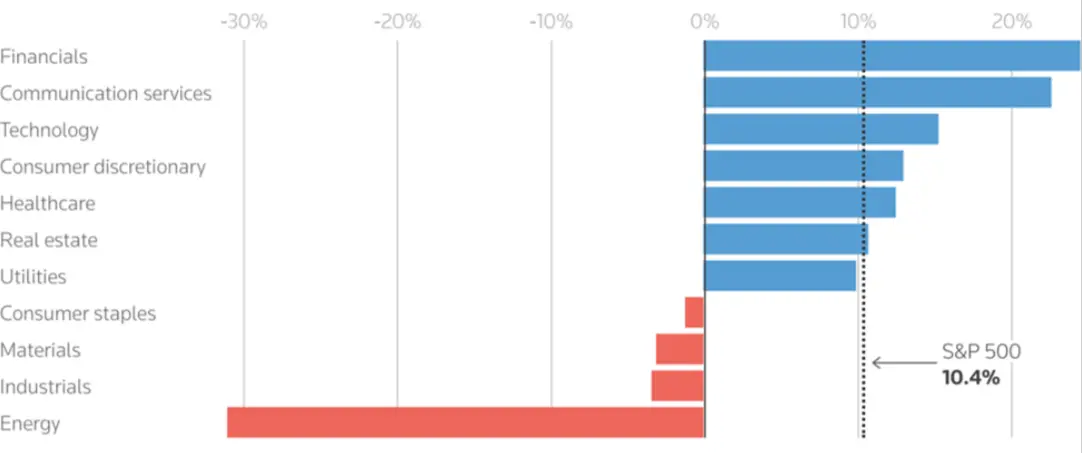

Next week, major U.S. companies like Netflix are set to release their earnings for Q4 2024. Projections indicate a 10.4% year-over-year increase in earnings for companies listed on the S&P 500. The earnings season kicked off on January 15, with major banks reporting higher profits driven by trading activity and a surge in merger and acquisition deals.

On the global front, Trump continues to influence ongoing conflicts in various regions. While there is some hope for regional stability, investors remain cautious about how these conflicts may evolve and impact the global economy.

In Europe, the economic crisis is worsening due to rising energy prices and borrowing costs. Oil prices have surged by 10% in January alone, fueled by concerns over the impact of Western sanctions on Russian oil. Meanwhile, the euro has fallen to its lowest levels against the dollar, increasing economic pressures in the region. Upcoming inflation data could also bring unwelcome surprises.

In Japan, the Bank of Japan is preparing for its first meeting of the year amid growing concerns about the yen’s decline against the U.S. dollar. The central bank is expected to discuss the possibility of raising interest rates, with a 70% chance of a 0.25% hike anticipated in January.