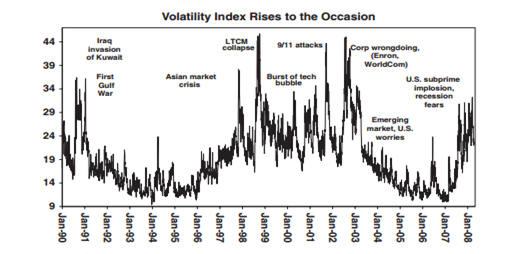

The volatility index (VIX) measures the volatility of a wide range of options on the S&P 500 Index and is used to gauge the markets’ expectations for volatility over the next 30 days. Quoted as a percentage, a VIX figure greater than 30 is associated with high volatility resulting from investors’ fear of uncertainty, while values under 20 are associated with relatively low volatility or less anxiety about the market. Low values may also reflect complacency arising from overconfidence with a rising market, or exuberance. Accordingly, the VIX is known as the fear index. During the market crash of October 1987, the VIX shot up to a record high of 172 from the mid-20s in the prior week.

Figure below shows how the VIX shot up in periods of extreme volatility, which were accompanied by sharp declines in equities. The catalysts to such declines included geopolitical events, sudden declines in business confidence, or escalating worries about losses in companies or industries. The advantage of using the VIX over stock indexes in gauging potential shifts in risk appetite is partly related to the components used in calculating the VIX index, namely the implied volatilities of various index options. As its name suggests, implied volatility is the variance or quantifiable risk of an individual stock or index option obtained via an option pricing model. Thus, sudden moves in stock indexes sometimes result from an aberration in a few selected stocks or simply profit-taking, in which case the impact may weigh on the broader index but is no indication of any shift in risk To the average trader or investor who may not have access to the intra-day developments of the VIX index, following the intraday fluctuations of the S&P 500 or the Nikkei-225 can be useful in detecting significant developments, which may trigger similarly important moves in currencies. But the main advantage of the VIX over equity indexes is its use as a benchmark reference for risk, hence offering a neutral perspective on market risk and appetite without referring to the price equities, and therefore the ability to pinpoint how sell-offs or rallies evolve.

Say, for instance, that stocks are falling across the board, down 2.5 percent. A greater and more useful perspective would be added to the moves in the event of a 2 to 3 percent jump in the VIX. But if the same equity developments are accompanied by more modest gains in the VIX, then there may be little inferred from the pullback in equities. The fact that the VIX is expressed in percentage terms allows it to be distinguishable and easily comparable to previous highs or lows regardless of time.