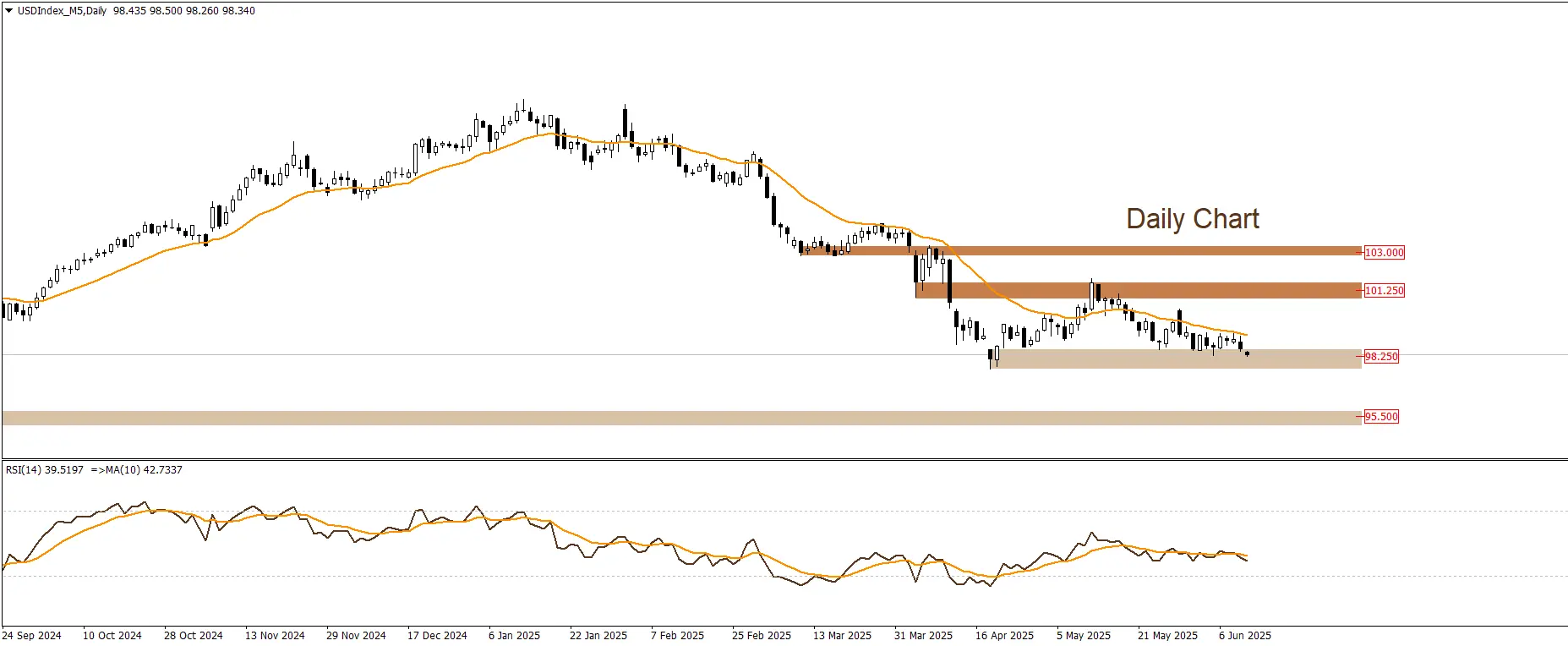

DOLLAR INDEX

The U.S. Dollar Index is trading above the support zone at 98.25, and prices are likely to move sideways between this mentioned support level and the resistance zone at 101.25 during today’s trading session.

|

Support |

98.25 | 95.50 | – |

| Resistance | 101.25 | 103 |

104.25 |

The US Dollar Index witnessed a notable decline, approaching the 98.2 level, following weaker-than-expected US inflation data. This drop came amid growing expectations that the Federal Reserve may move toward cutting interest rates in the coming months, especially as price pressures appear to be easing. The data also strengthened competing currencies such as the euro and yen, putting additional pressure on the dollar and erasing some of its recent gains.

From a technical perspective, the Dollar Index is nearing a strong support zone between 98.10 and 98.00, which may temporarily limit the downside. The nearest resistance appears at the 99.38 level. Analysts believe that a break below this support zone could lead to further declines toward 97.70 or even 96.55, reflecting market caution and anticipation ahead of the Fed’s upcoming decisions and its monetary policy direction.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.