USDJPY

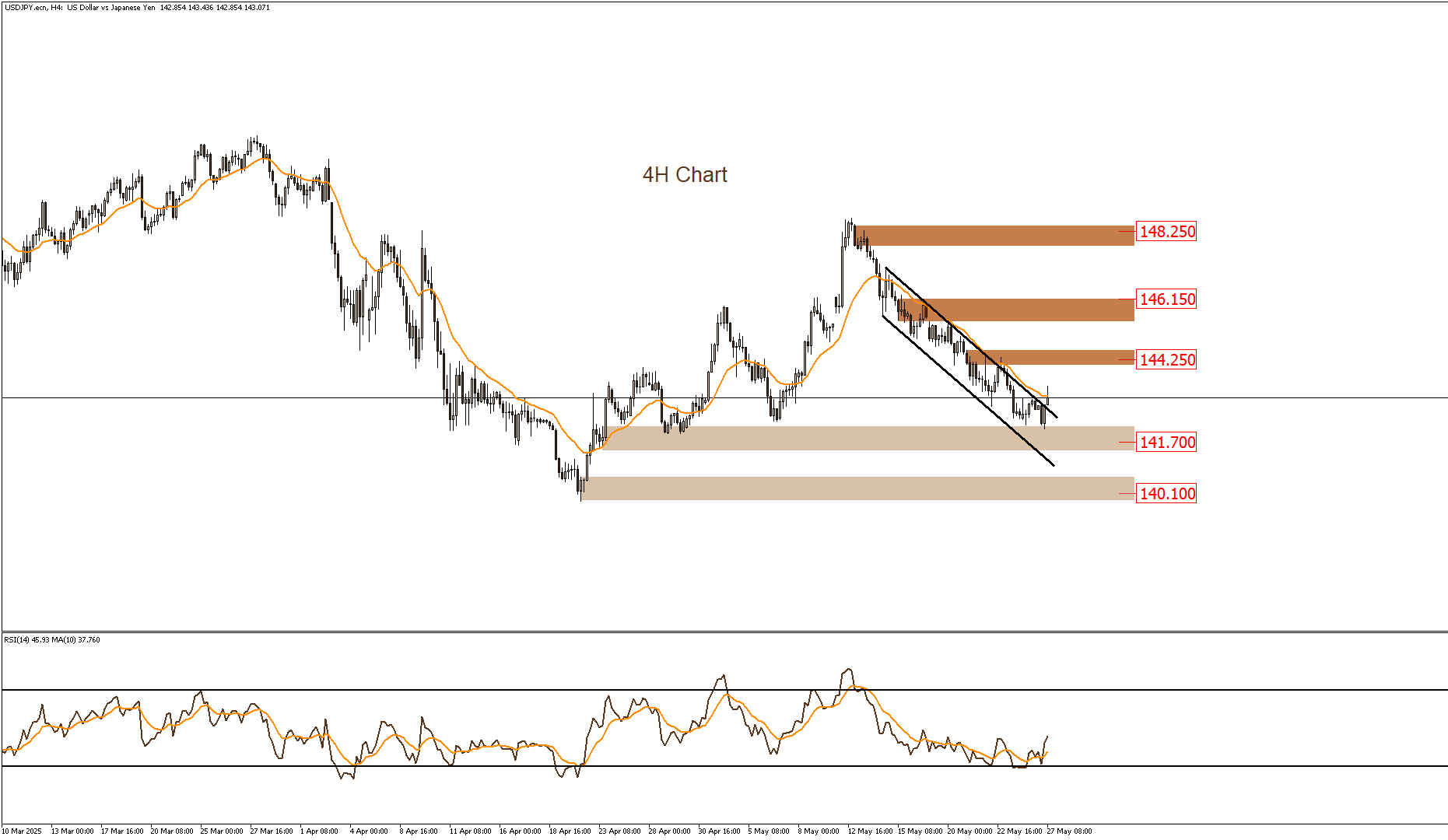

The USD/JPY pair is trading above the support level of 141.70, and prices are likely to target the resistance level of 144.25. This scenario would be invalidated if the aforementioned support level is broken to the downside.

|

Support |

141.70 | 140.10 | – |

| Resistance | 144.25 | 146.15 |

148.25 |

The USD/JPY pair witnessed a notable rise, reaching the level of 144.04 yen, marking an increase of 0.34%. This upward movement was supported by several factors, most notably statements from Bank of Japan Governor Kazuo Ueda, who emphasized that the bank is not in a hurry to raise interest rates. This led to a weakening of the Japanese yen and strengthened the US dollar. Additionally, strong US inflation data reinforced expectations that American interest rates will remain high, further boosting the dollar’s appeal in the markets.

On another front, the positive sentiment in global markets also supported the dollar’s movement, especially after the US President announced a delay in imposing tariffs on imports from the European Union, easing trade tensions. Despite this rise, technical indicators show that the USD/JPY pair remains in an overbought zone, suggesting a potential price correction soon. Meanwhile, financial institutions such as UBS forecast that the pair may reach the 150 level in the coming period if the dollar’s positive momentum continues.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.