The Bank of Japan (BoJ) is scheduled to hold a monetary policy meeting from January 23 to 24, 2025, with strong market expectations of a 25-basis-point rate hike, potentially raising the main interest rate from 0.25% to 0.50%. This follows comments from BoJ Governor Kazuo Ueda indicating that policymakers would consider a rate increase, particularly in light of recent updates to growth and inflation forecasts.

This meeting is considered pivotal, as it is expected to involve precise communication to avoid sharp market volatility, especially after the missteps seen in July 2024. Should the BoJ surprise markets by leaving rates unchanged, the yen may initially weaken, although a firm tone from the central bank might help mitigate the decline.

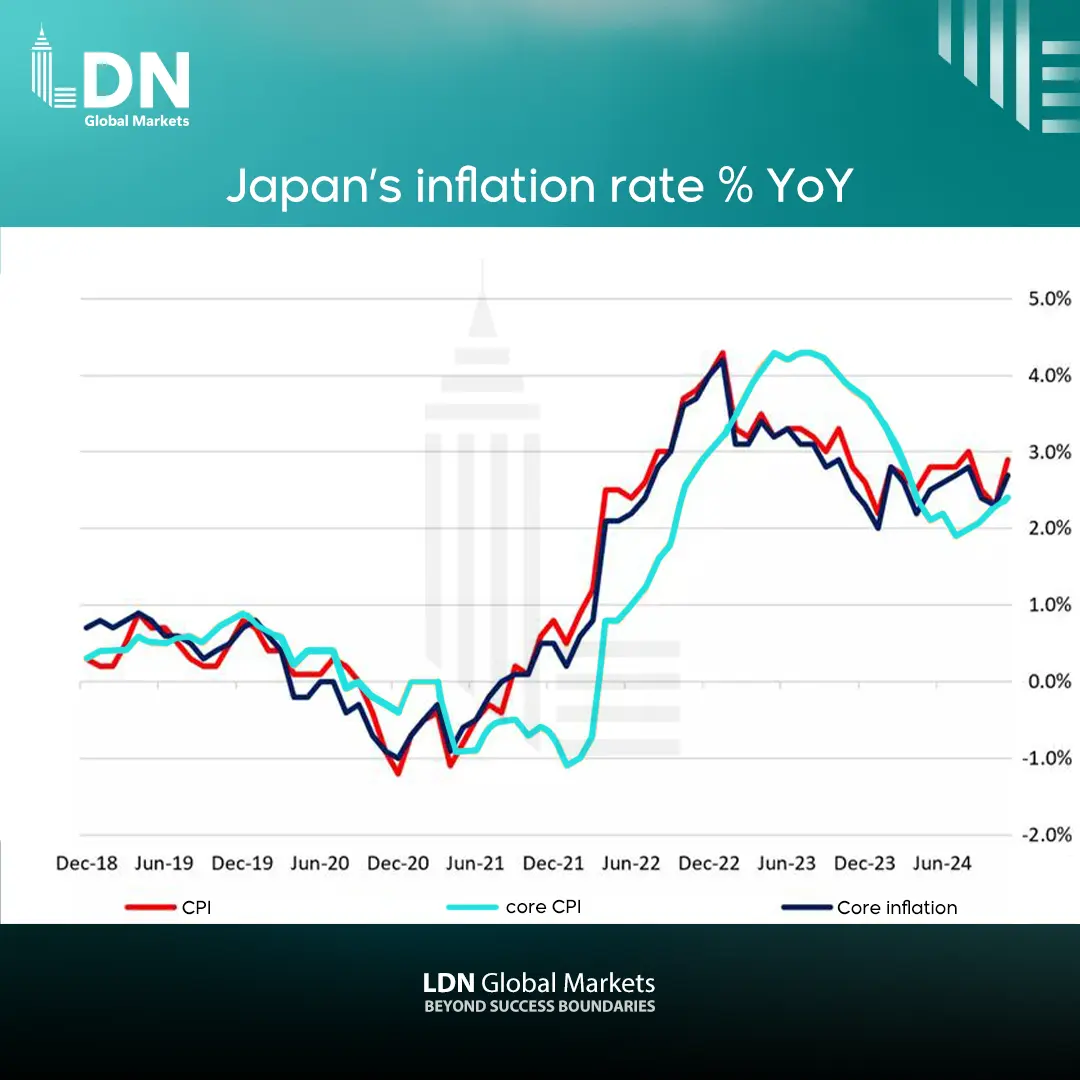

Inflation in Tokyo rose in December, with the Consumer Price Index (CPI) hitting 3% and the core CPI at 2.4%, reinforcing expectations of a rate hike. Furthermore, wage increases suggest that inflationary pressures may spread nationwide. This could prompt the BoJ to adjust its inflation outlook, despite lingering concerns about weak consumption.

The BoJ’s decision in December to keep rates unchanged was partly influenced by uncertainty surrounding U.S. economic policies. Market reactions to political developments in the United States, particularly comments from President Trump, could lead the BoJ to delay or revise its plans for raising interest rates.