Current and Future Political Impacts on Gold:

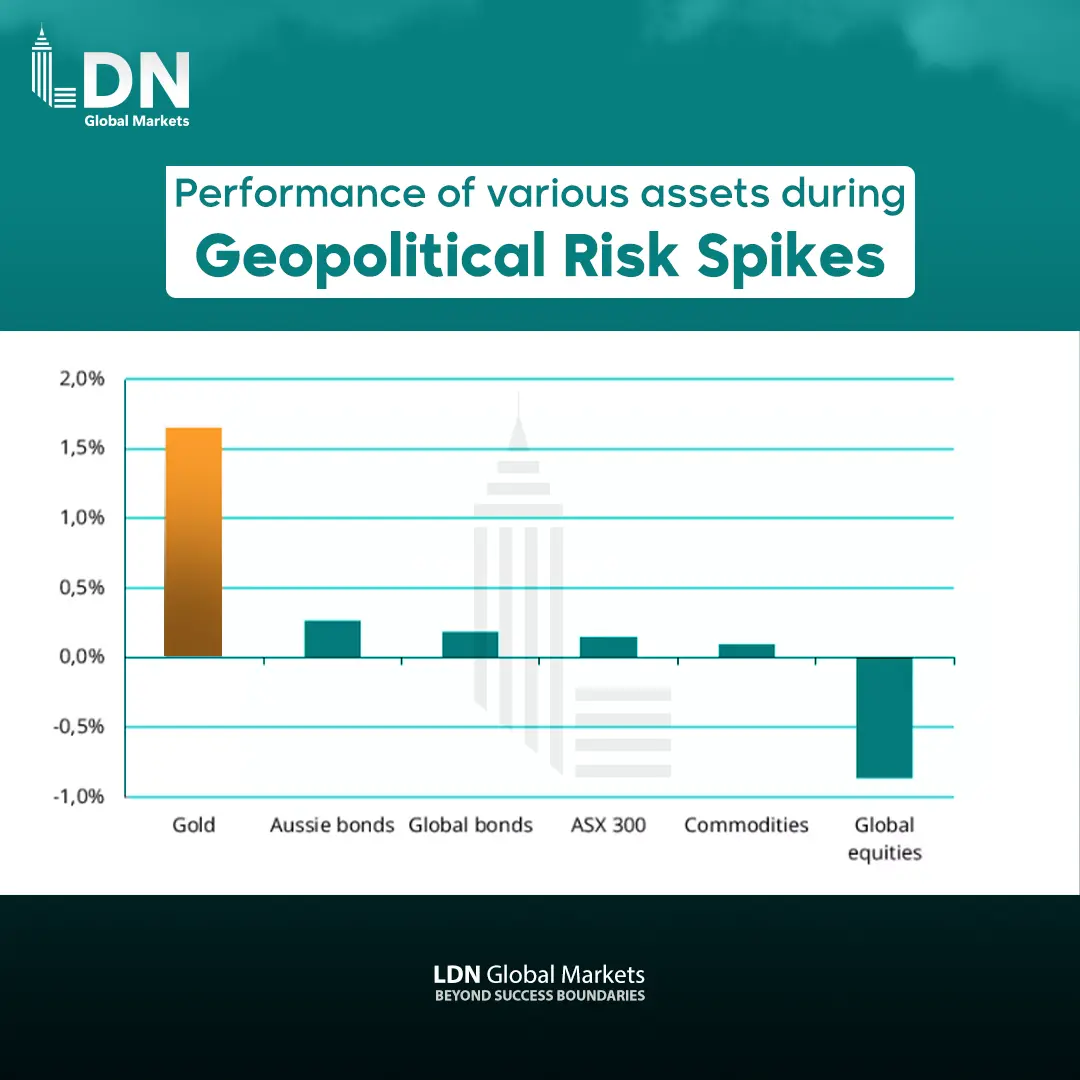

Gold is more than just a precious metal; it is a strategic asset with a significant influence on global politics. Changes in economic and geopolitical policies create massive fluctuations in gold markets, as investors turn to this precious metal as a safe haven during times of economic and political crises.

Geopolitical tensions in Ukraine have notably increased demand for gold, as the world has witnessed a sharp rise in military conflicts and economic instability due to the war between Russia and Ukraine.

The war in Gaza has also been a key factor in driving gold demand. The escalating geopolitical tensions in the Middle East have led investors to seek safe assets to protect their wealth.

How Economic Conflicts Between Major Powers Have Affected Gold:

The trade war between China and the U.S. was one of the key events that reinforced gold’s role as a safe haven. China imposed targeted tariffs on U.S. imports in response to Trump’s tariffs, escalating economic tensions between the world’s two largest economies.

Additionally, disruptions in energy markets and economic sanctions imposed by Western countries on Russia have further boosted gold’s appeal. Moreover, rising inflationary pressures in many countries have also contributed to increased demand for gold.

The Role of Central Banks as a Key Driver of Gold Prices:

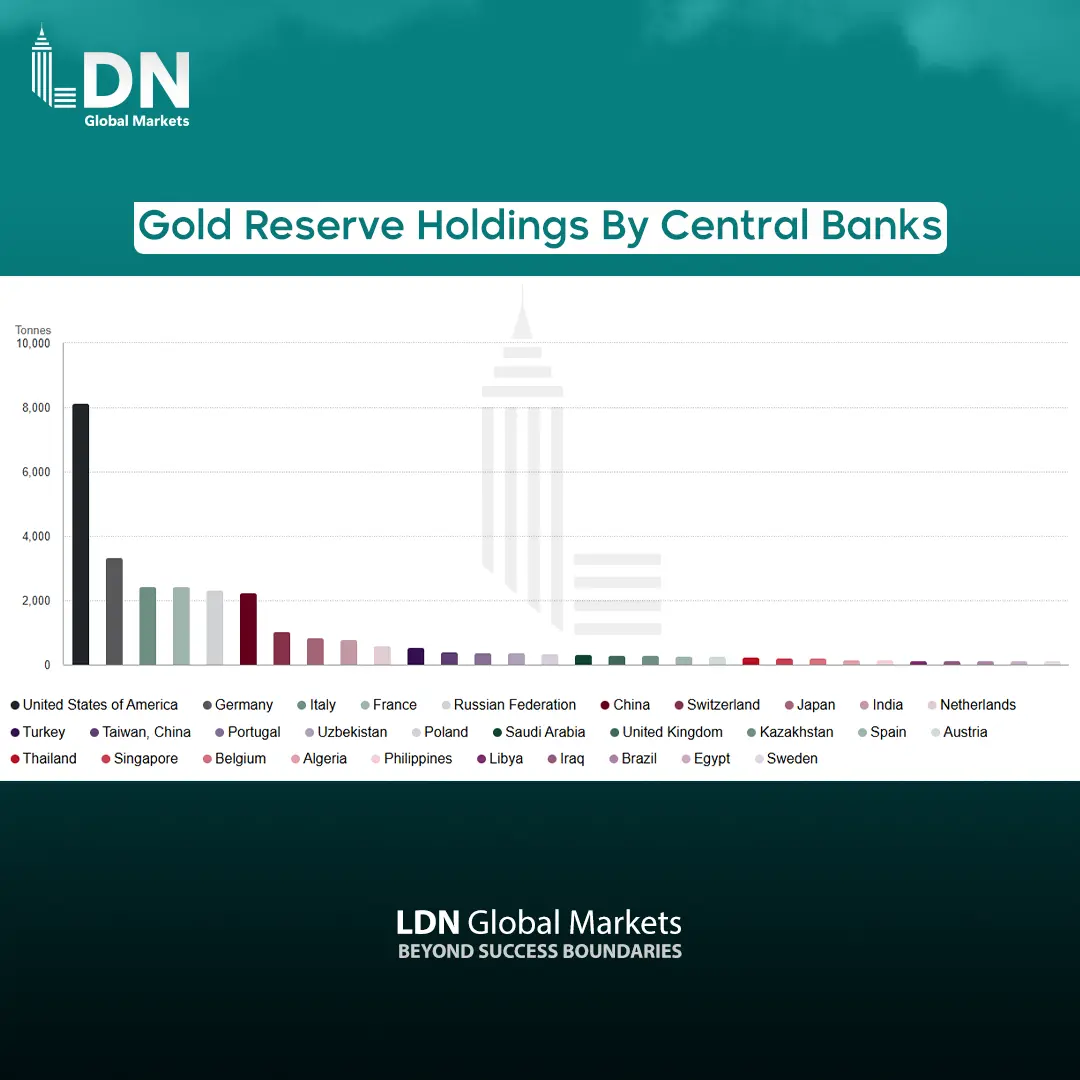

In recent years, the gold market has undergone a significant transformation, with central banks emerging as a pivotal force in determining global gold prices. Amid escalating geopolitical and economic tensions, many central banks are diversifying their financial reserves and reducing their reliance on fiat currencies.

In 2023, central banks recorded their highest level of gold purchases, adding 1,037 tons to their reserves—marking the second-highest annual purchase in market history after the record set in 2022. China, Poland, and Singapore led these acquisitions, reflecting the growing demand for gold as a safe-haven asset amid economic volatility. Notably, the People’s Bank of China resumed its gold purchases in November 2024, bringing its total gold reserves to 72.96 million ounces.

Central banks do not buy gold solely as a financial investment; rather, it is part of a long-term strategy aimed at enhancing financial security and reducing exposure to risks associated with excessive reliance on the U.S. dollar. Within this context, central banks are expected to remain the primary driving force in the gold market.

Despite a sharp 39% decline in central bank gold purchases during Q2 2024 compared to Q1, total demand in the first half of the year reached 483 tons, marking the highest level recorded to date. Quarterly purchases also exceeded the five-year average by 3%, highlighting the continued appetite for gold as a strategic reserve asset, driven by inflation concerns and economic uncertainty.

Central banks, particularly in emerging markets, continue to drive this activity, with 14 monetary institutions adjusting their gold reserves by at least one ton. The National Bank of Poland and the Reserve Bank of India led the buying spree in Q2 2024, each adding 19 tons to their reserves. Meanwhile, the Central Bank of Turkey recorded the largest net purchases since the beginning of 2024, with a total acquisition of 45 tons. On the other hand, the Monetary Authority of Singapore was the only institution from developed markets to increase its gold holdings, highlighting a divergence in gold strategies between emerging and advanced economies.

Following a period of aggressive accumulation, the People’s Bank of China slowed its gold purchases, adding only 2 tons in April 2024, with no further increases reported in May or June. This could indicate a reassessment of accumulation strategies amid rising prices. Surveys suggest that 81% of central banks anticipate an increase in global gold reserves this year.

In 2024, central banks exhibited strong interest in gold, with total purchases reaching 1,045 metric tons, valued at approximately $96 billion. Poland, India, and Turkey ranked as the top buyers.

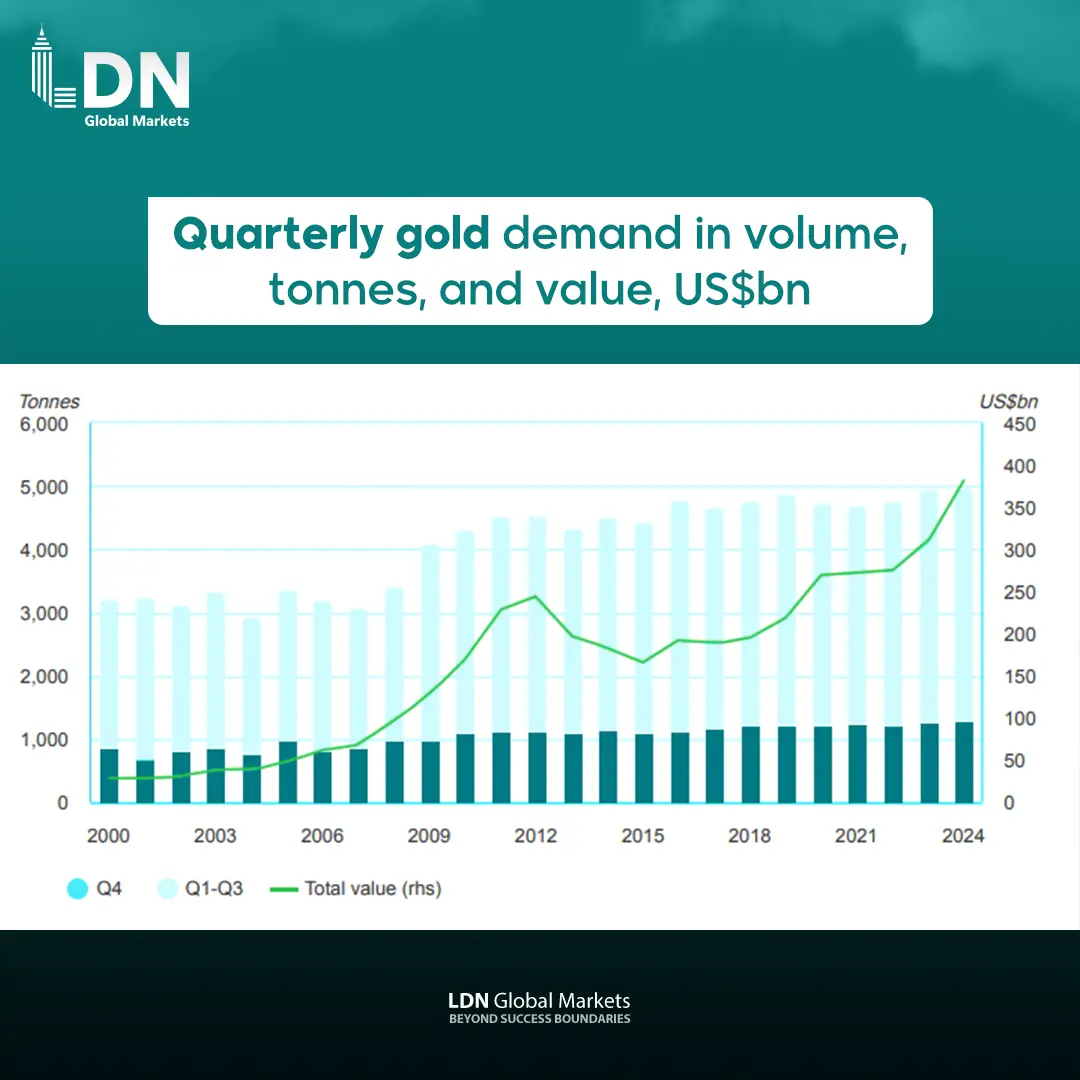

Global gold purchases reached 4,974 tons, marking the highest level in history, reinforcing gold’s position as a safe investment asset. Despite this momentum, the jewelry sector saw an 11% decline, impacted by rising prices. China, in particular, recorded a sharp drop in jewelry consumption, falling behind India for the second time in three years.

Despite record gold purchases in 2024, there are no signs of declining institutional demand. Analysts predict that central banks will remain the primary market driver, alongside growing interest from gold exchange-traded fund (ETF) investors. Additionally, lower interest rates may further enhance gold’s appeal, potentially pushing prices to new record highs. Meanwhile, gold mine production is expected to remain stable, with an increase in gold recycling activities supporting market supply.

![شكل 4 9-2-2025]()

Challenges Facing Gold Mining:

Gold mining companies have continued to face increasing inflationary pressures during Q2 2024, with all-in sustaining costs (AISC) rising to $1,388 per ounce, reflecting a 6% year-on-year increase. In contrast, cash operating costs saw a slight decline to $938 per ounce, mainly due to a 3% drop in Brent crude prices, providing some relief to energy-dependent mining regions such as Australia, Canada, and the United States. However, overall costs remain higher than in 2023, driven by rising wages, increased royalties, and higher sustaining capital expenditures.

Labor costs were one of the primary factors contributing to higher expenses, with Australian mining sector wages increasing by 4% year-on-year, alongside similar rises in Ghana, Argentina, and South Africa. At the same time, soaring gold prices led to a 22% rise in royalties and production taxes compared to the previous year, significantly impacting mining companies operating in Nevada, Mali, and Ghana. This environment has forced companies to reassess production strategies, focusing on processing lower-grade ores to maintain profit margins amid rising expenditures.

Higher gold prices have helped support profit margins for producers, with average profitability reaching $950 per ounce, the highest level since 2012. This has enabled companies to offset rising costs, with 97% of gold mining firms continuing to generate positive earnings.

The Impact of Recycling on Gold Prices:

Gold recycling, which involves recovering gold from old jewelry and electronics, helps meet market demand and reduces reliance on mining. This process increases supply and stabilizes prices, especially when gold mine production is limited.

Recycled gold contributes to price stability during periods of high demand, but it is not sufficient to fully meet global demand.

When prices rise, recycling becomes more profitable, leading to an increase in supply. Conversely, when prices decline, recycling activity decreases, which in turn drives prices higher.

The Impact of the Electronics Sector on Gold:

According to recent statistics, the jewelry sector remains the largest consumer of gold. However, with the increasing use of gold in technological industries, such as electronics, demand has become more diverse and complex. Additionally, technological advancements—such as the rising need for gold in smartphone manufacturing and the development of artificial intelligence (AI)—may further drive gold consumption in the future. This enhances its market value and contributes to price increases.

The technology sector is the largest industrial consumer of gold, with its usage increasing by 9% year-on-year in Q3 2024. This growth was driven by the expansion of major manufacturing hubs in Japan (+20%), South Korea (+20%), and China & Hong Kong (+10%). In contrast, the United States recorded a 4% decline in gold usage within the electronics industry. Despite the continued rise in smartphone shipments, manufacturers have adopted a cautious approach due to signs of a potential economic slowdown.

The rapid advancement of 5G technology and artificial intelligence (AI) is boosting demand for gold in the electronics industry, particularly in smartphones and advanced printed circuit boards (PCBs). Additionally, the automotive sector is witnessing increased gold consumption in sophisticated electronic systems to ensure high-performance functionalities.

Furthermore, demand for gold is rising in low Earth orbit (LEO) satellites, as the telecommunications and space internet industries rely on gold-containing electronic components, making this one of the most promising areas for future gold demand growth.

Although gold is not directly used in cryptocurrency mining, it plays a crucial role in manufacturing mining hardware, particularly ASIC chips, which require gold for its superior electrical conductivity. As demand for crypto mining equipment increases, gold usage in technology may also rise.

Moreover, gold is being integrated into the crypto world through gold-backed tokens, where digital currencies are tied to physical gold. This could further increase market demand for gold.

While these factors may influence gold prices, their impact is expected to be gradual and limited.

Gold Consumption in the Technology Sector – 2025 Outlook

Forecasts for gold consumption in the technology sector in 2025 suggest promising trends based on recent reports and analyses:

-

Semiconductor Demand Growth: The semiconductor industry, one of the largest consumers of gold in electronics and computing, is expected to expand significantly.

-

5G Wireless Technology: As 5G networks continue to expand, demand is expected to increase for wireless components such as connectors, switches, and semiconductors, many of which require gold.

-

Printed Circuit Boards (PCBs): With the increasing complexity of electronic devices, including AI servers, consumer electronics, and automotive electronics, demand for gold in PCBs is expected to grow.

In 2024, the technology sector was projected to consume approximately 300 metric tons of gold, based on observed trends from previous years and expected growth in key industries like AI and telecommunications. In 2025, gold demand in this sector is likely to increase slightly or remain stable compared to previous years.

Major Banks’ Gold Price Forecasts:

Forecasts from major investment banks indicate that gold prices will continue their upward trend over the next year, driven by various economic and geopolitical factors.

-

Citibank expects gold prices to reach $3,000 per ounce within the next six months, reflecting increased investment demand amid global market volatility.

-

Goldman Sachs projects that gold will rise to $2,900 per ounce this year, supported by positive market momentum.

-

J.P. Morgan predicts that gold will hit $3,100 per ounce by the end of 2025.

-

Morgan Stanley holds the most optimistic outlook, forecasting that gold could reach $3,200 per ounce by the end of the year.