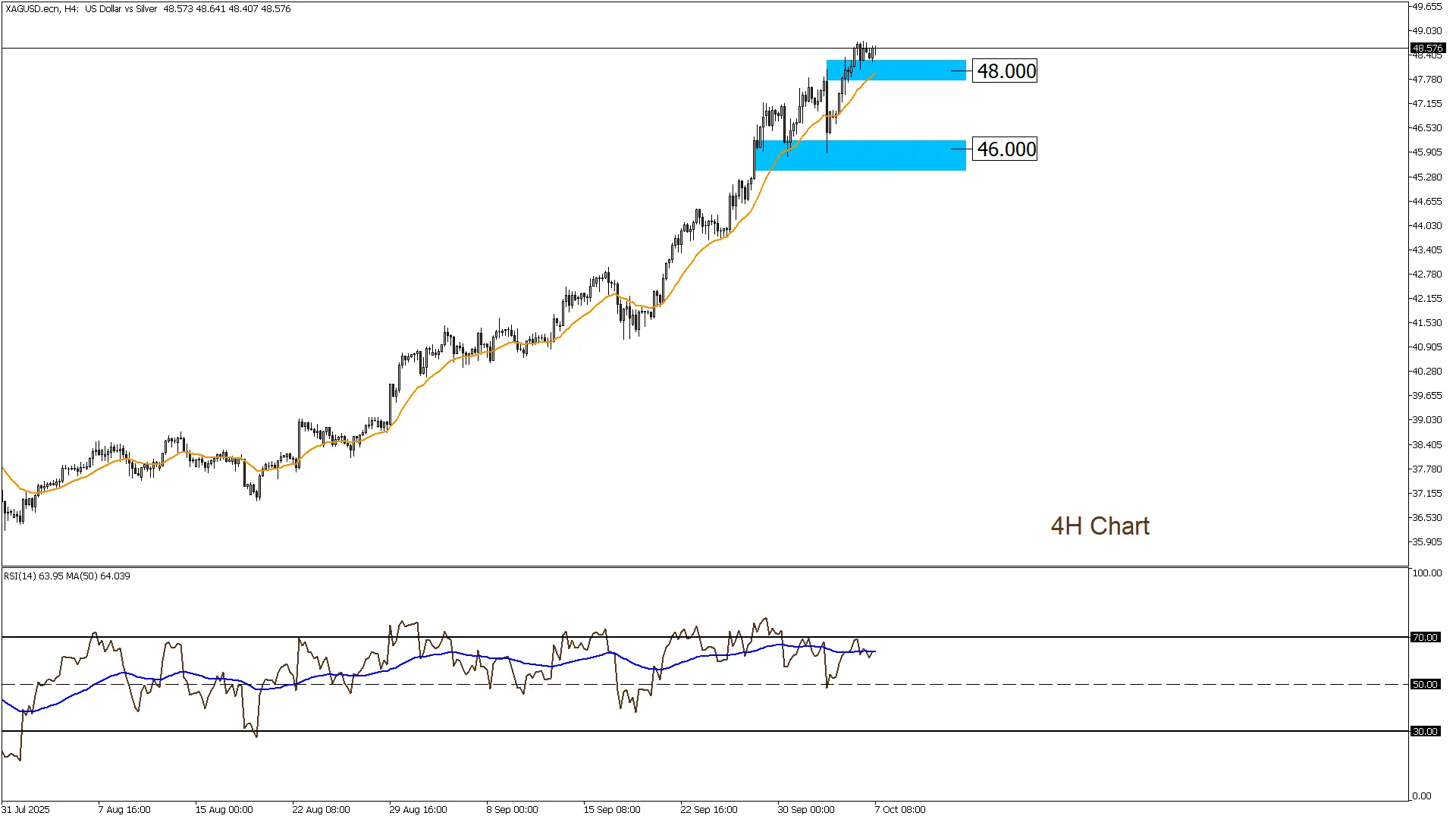

The metals markets witnessed a strong surge in silver prices, reaching their highest levels since 2011. This rise was driven by a wave of strong demand from investors seeking safe haven assets amid growing expectations of a decline in U.S. interest rates. The weakness of the U.S. dollar and the rise in gold prices also supported silver’s upward momentum, especially as renewed interest in precious industrial metals emerged amid optimism about improving global industrial activity.

Technically, silver has broken through historical resistance levels, which could pave the way for further gains if prices remain stable above the new support zone.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.

I find it interesting that the price surge in silver is being driven by a mix of safe haven demand and industrial use. It’s a reminder of how interconnected the precious metals market is with both economic and industrial factors.