On Balance Volume (OBV) is one of the most widely used technical indicators for confirming price trends and anticipating potential market reversals. Instead of analyzing raw volume data, OBV transforms trading volume into a cumulative line that reflects whether buyers or sellers are driving the market. When the OBV line moves in the same direction as price, it strengthens the trend’s reliability; however, when the OBV diverges from price, it often signals a weakening trend and a possible reversal. This makes OBV a powerful tool for traders seeking to understand market momentum and improve the accuracy of their technical analysis.

On Balance Volume

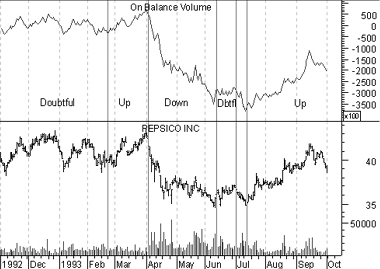

An accumulated total of volume. The basic premise behind On Balance Volume is that changes in it will be seen before price changes. On Balance Volume is often used because it’s easier to visualize than the volume. The trend direction of the On Balance Volume line is what is evaluated, not the actual numbers, and confirms the actual instrument’s trend. The On Balance Volume should closely match the actual trend. An indication of a possible trend reversal occurs when the On Balance Volume does not go in the same direction as the trend line.

Example :

The following chart shows Pepsi and the On Balance Volume indicator. I have labelled the OBV Up, Down, and Doubtful trends.

Calculation :

On Balance Volume is calculated by adding the day’s volume to a cumulative total when the security’s price closes up, and subtracting the day’s volume when the security’s price closes down.

If today’s close is greater than yesterday’s close then:

![]()

If today’s close is less than yesterday’s close then:

![]()

If today’s close is equal to yesterday’s close then:

On Balance Volume is calculated as follows:

1- If today’s close is greater than yesterday’s close, then today’s volume is added to yesterday’s On Balance Volume. This is considered an up-volume.

2- If today’s close is less than yesterday’s close, then today’s volume is subtracted from yesterday’s On Balance Volume. This is considered a down-volume.

3- If today’s close is equal to yesterday’s close, then the On Balance Volume will equal yesterday’s On Balance Volume.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.