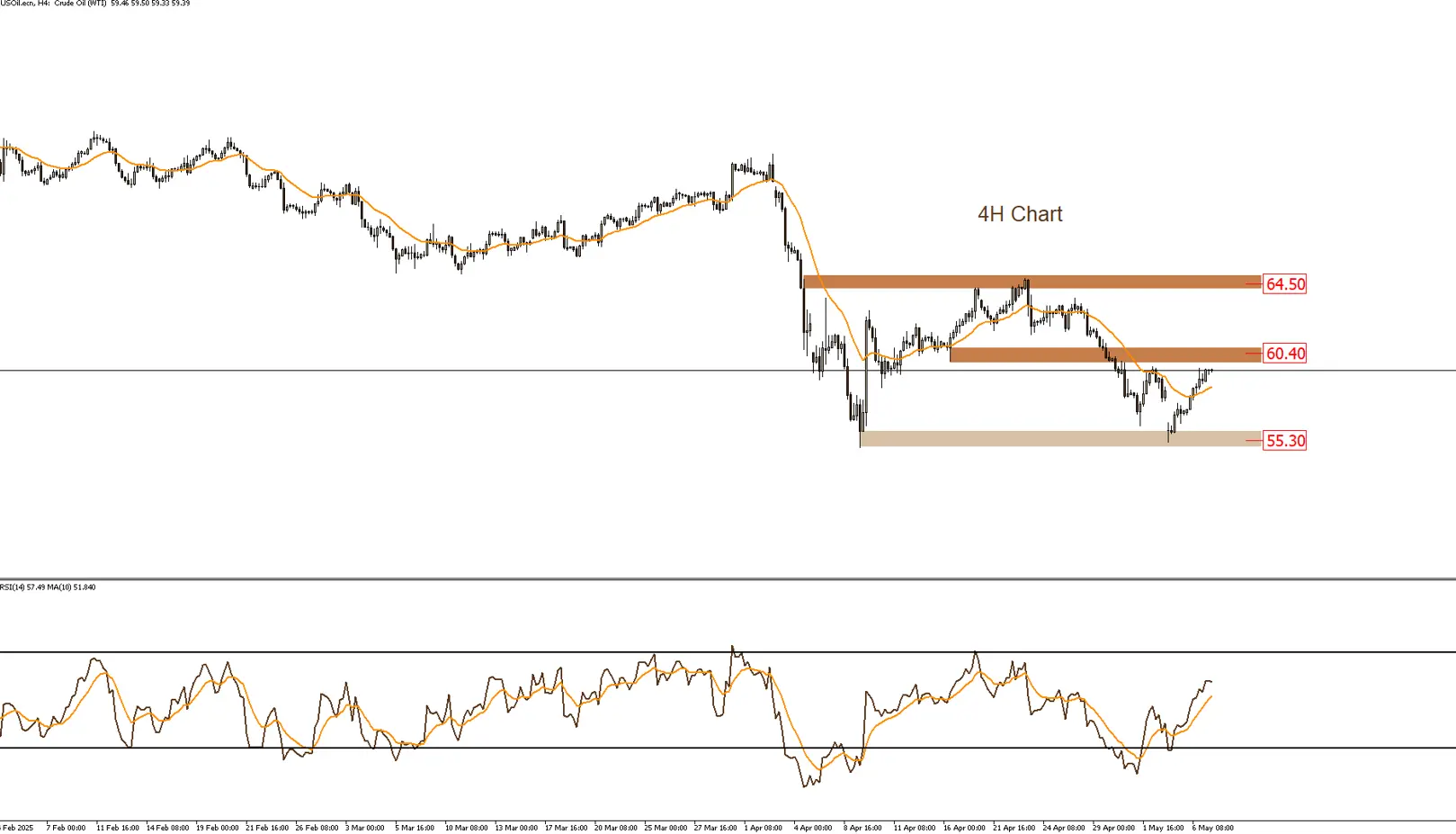

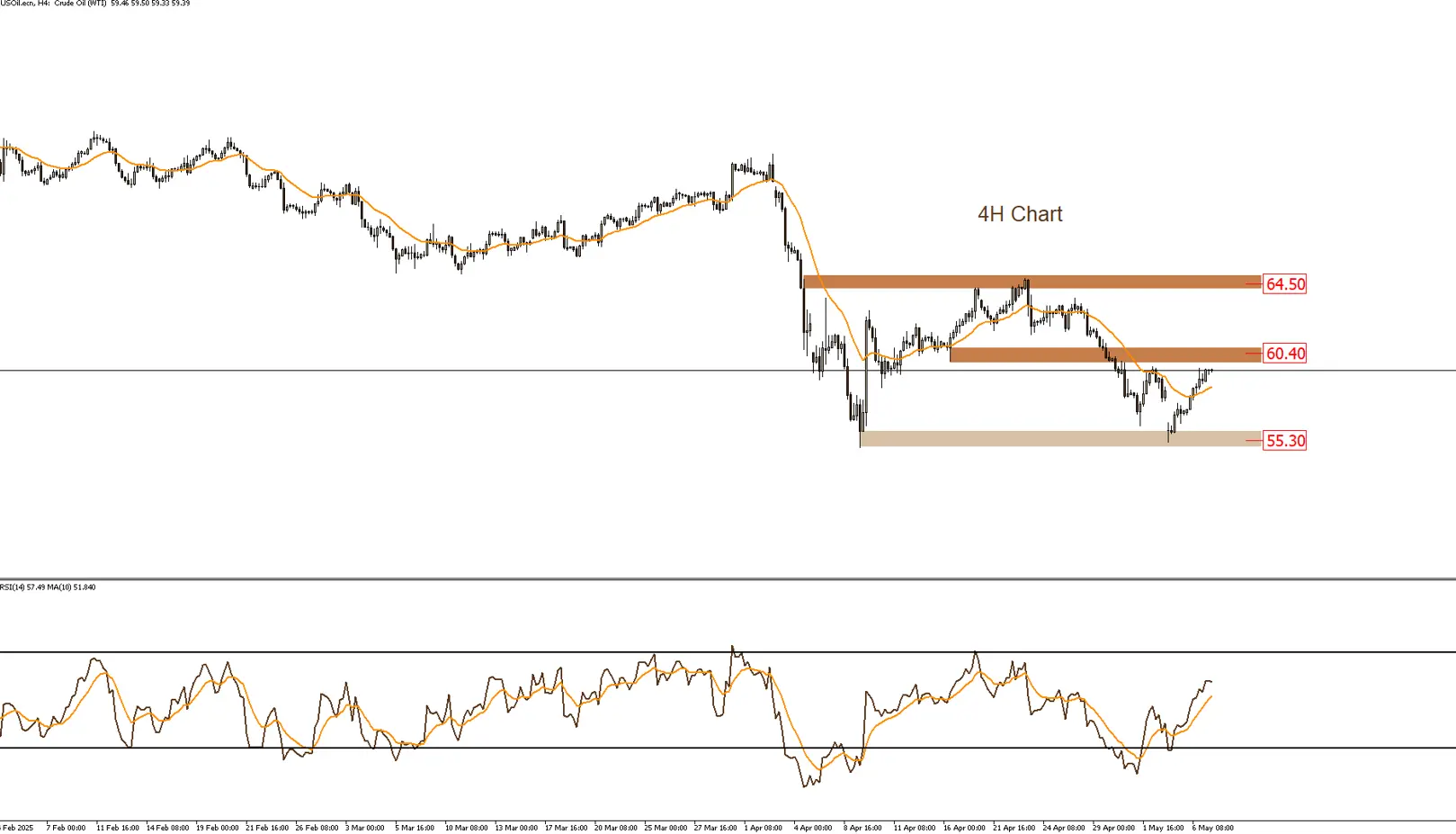

USOIL

Oil is trading below the resistance level at $60.40, and this zone is likely to limit the pace of the upward movement during today’s trading.

|

Support |

55.30 | 52.50 | – |

| Resistance | 52.50 | 64.50 |

– |

|

Support |

55.30 | 52.50 | – |

| Resistance | 52.50 | 64.50 |

– |

Mostafa Mahmoud Technical Analyst at LDN Mostafa has half a decade of experience in the field of financial markets between technical analysis and financial portfolio management, which extends to more than one financial market between stocks, commodities, currencies and the debt markets.