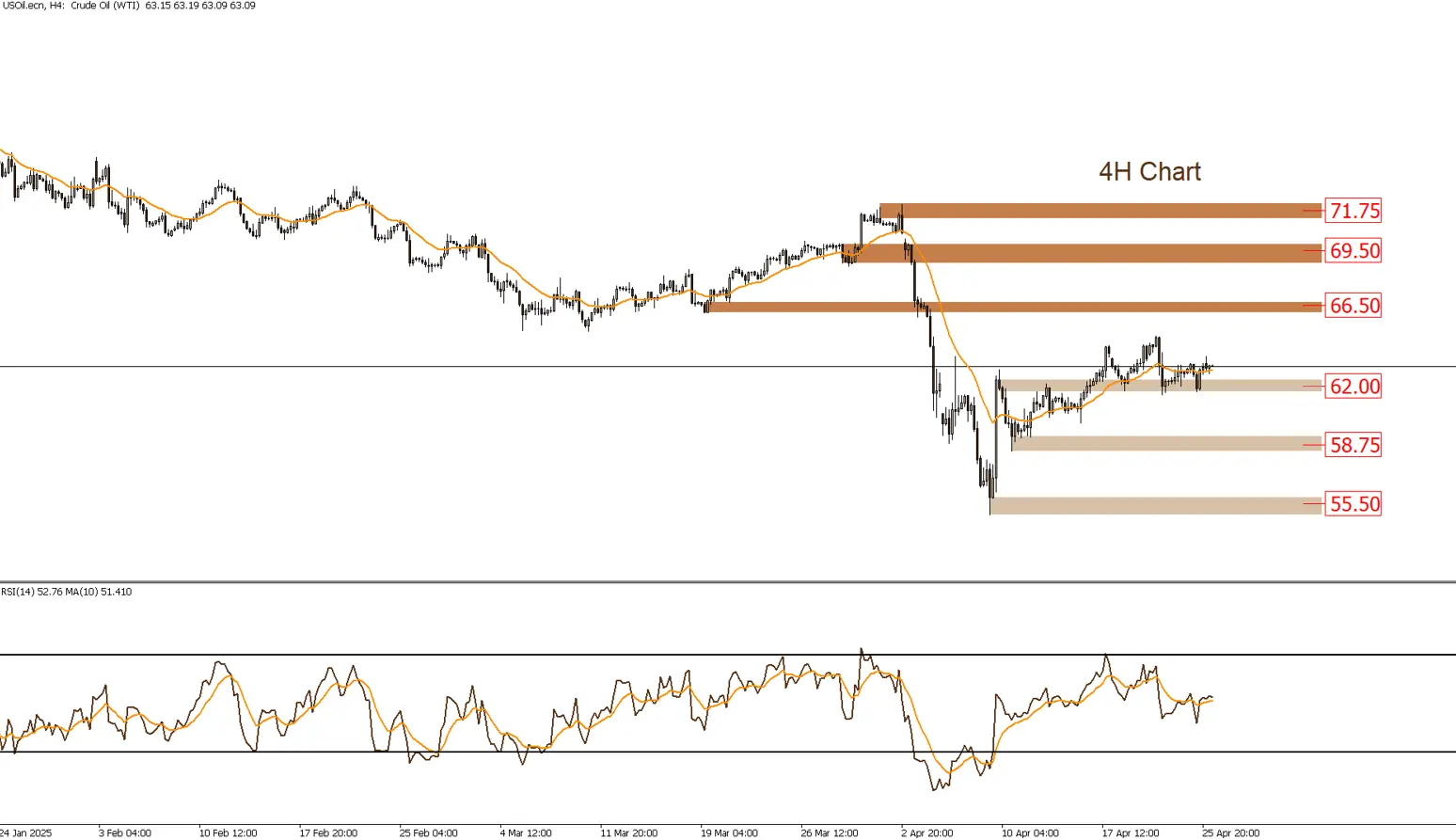

USOIL

Oil is trading above the support zone of $62, and prices are likely to rise and retest the resistance zone of $66.50. However, this scenario would be invalidated if the aforementioned support zone is broken to the downside.

|

Support |

62 | 58.75 | 55.50 |

| Resistance | 66.50 | 69.50 |

71.75 |

Crude oil prices recorded a slight increase, with Brent crude rising to $67.09 per barrel and West Texas Intermediate (WTI) reaching $63.26 per barrel, marking the third consecutive session of gains.

Fundamental Factors

Oil prices were influenced by several fundamental factors, including:

-

Production Policies: Markets are anticipating the upcoming OPEC+ meeting scheduled for May 5, where members are expected to discuss the possibility of increasing production, which could impact the supply-demand balance.

-

Global Economy: Ongoing uncertainty regarding global economic growth, particularly amid trade tensions between the United States and China, which could affect global oil demand.