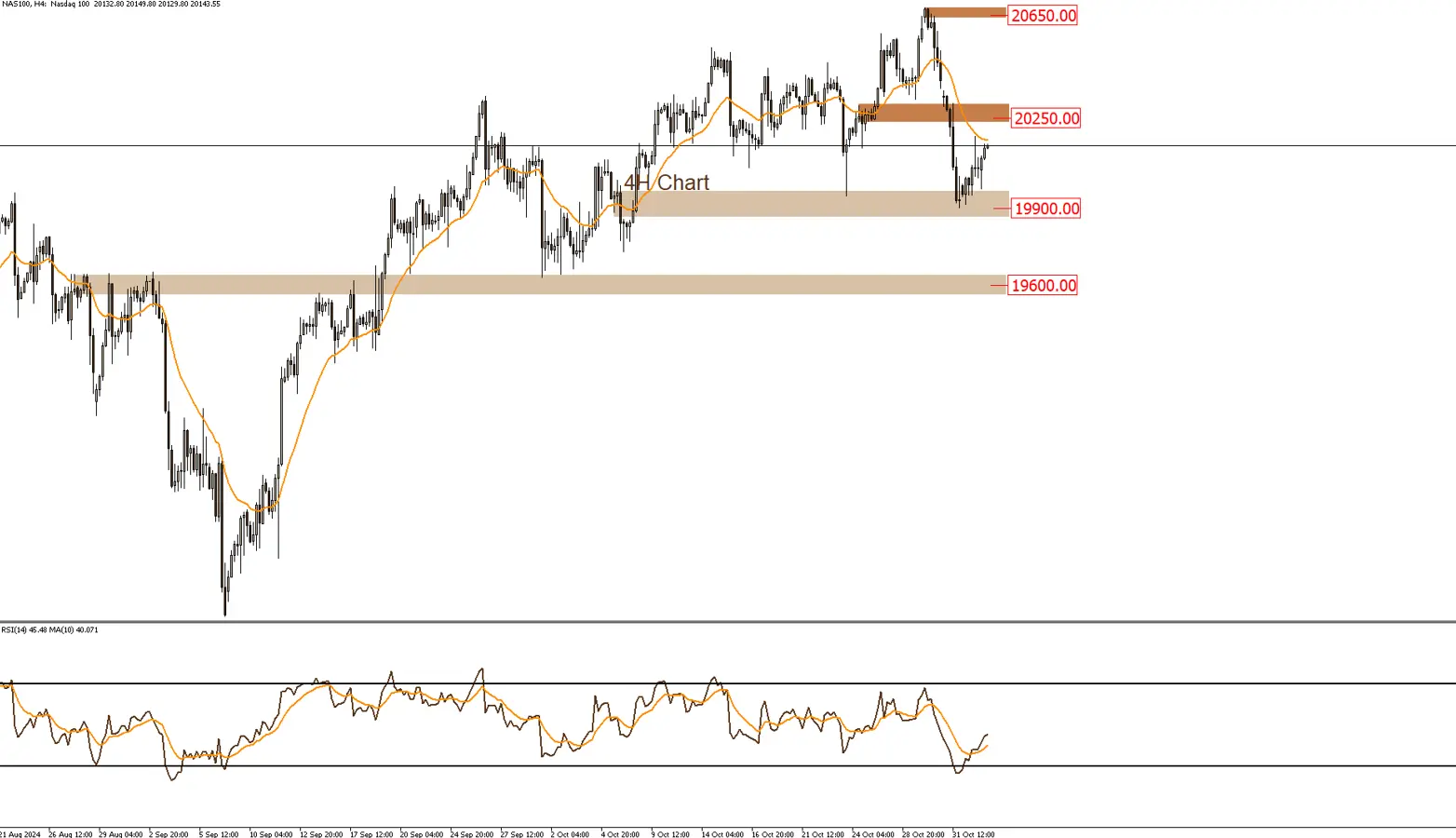

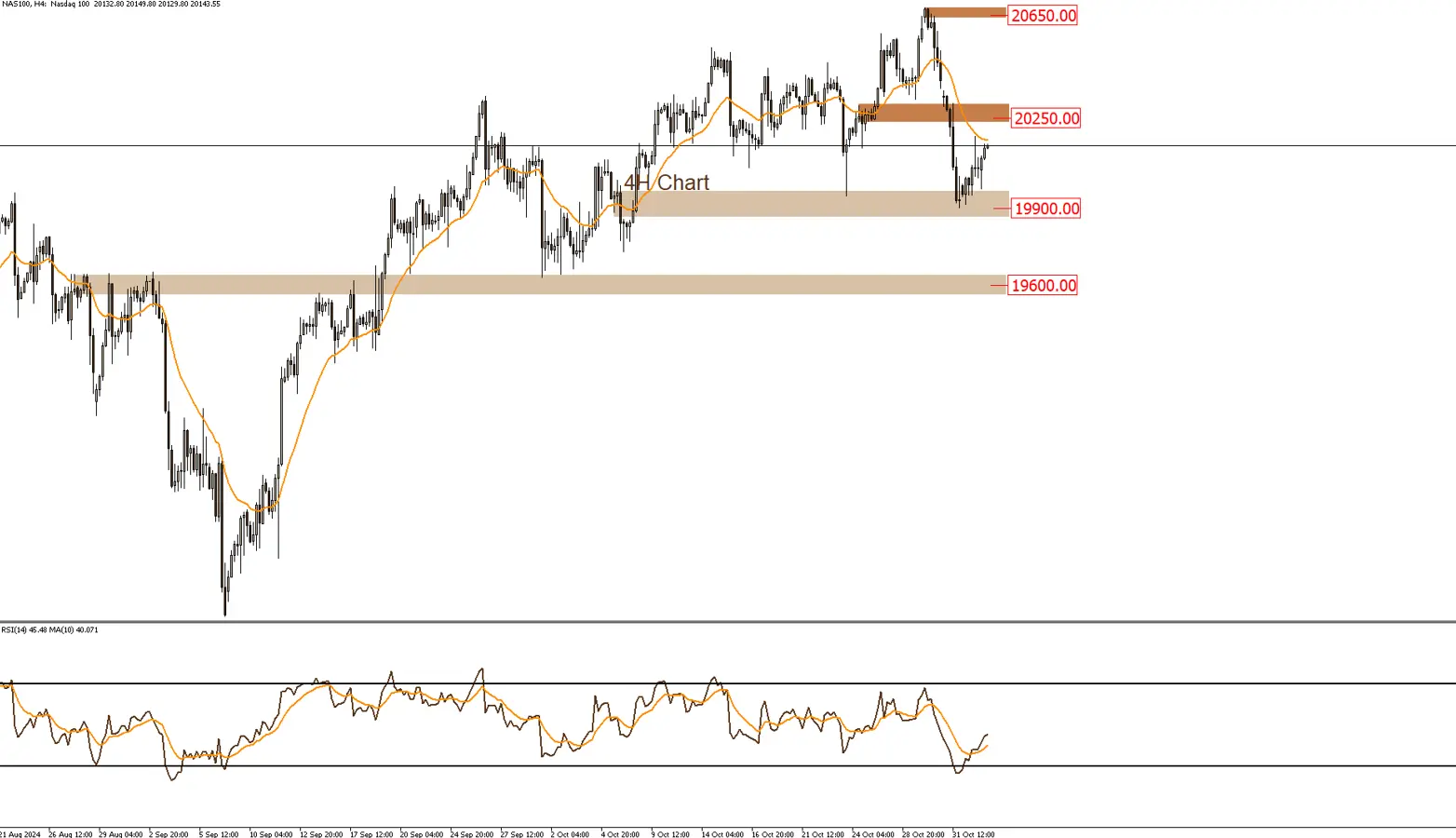

NASDAQ

The Nasdaq index is moving in an upward trend, and prices are likely to target the resistance area at $20,250. This scenario is invalidated if the support level at $19,900 is broken.

|

Support |

19900 | 19600 | – |

| Resistance | 20250 | 20650 |

– |

|

Support |

19900 | 19600 | – |

| Resistance | 20250 | 20650 |

– |

Mostafa Mahmoud Technical Analyst at LDN Mostafa has half a decade of experience in the field of financial markets between technical analysis and financial portfolio management, which extends to more than one financial market between stocks, commodities, currencies and the debt markets.