Markets experienced a new wave of confusion on Wednesday following the late-night release of a clarifying document by the White House, revealing that some Chinese imports to the U.S. could face tariffs as high as 245%. This figure sparked widespread controversy, as it far exceeded the 145% estimate that markets had been factoring in, leading to anxiety and fluctuations in reactions.

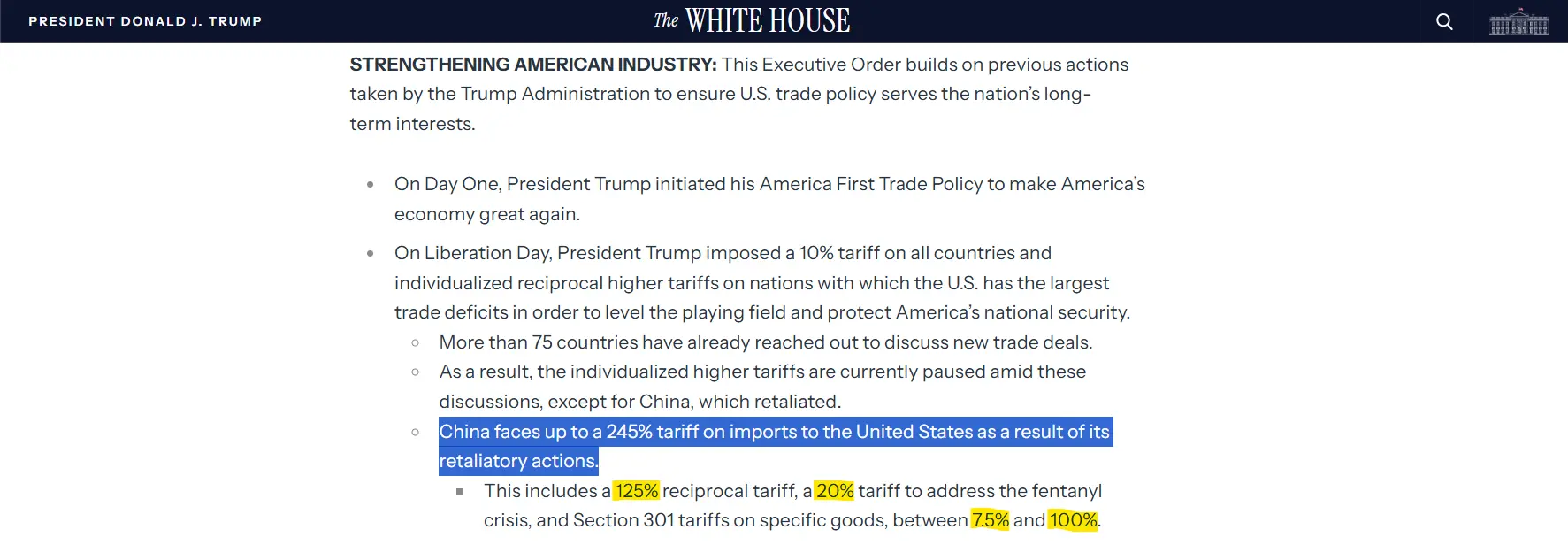

The document stated: “China now faces tariffs up to 245% on its imports to the U.S. due to its retaliatory actions.” This statement led many to believe that new tariffs had been imposed, adding to the confusion in the market.

In an effort to calm the situation, the White House quickly clarified the matter, correcting the misunderstanding and emphasizing that the 245% rate was not a new measure, and that its portrayal in this way was “misleading.”

The White House explained that the 100% additional tariffs imposed on certain Chinese goods were already in effect, meaning the total 245% figure was a result of several accumulated tariffs, not a new decision.

According to the official clarification, this figure includes:

-

125% reciprocal tariffs (in response to previous Chinese actions)

-

20% additional tariffs related to combating the fentanyl crisis

-

Section 301 tariffs on certain goods, ranging from 7.5% to 100%

After the clarification, the market regained some stability, but the incident highlighted the complexity and chaos surrounding the tariff issue on Chinese goods, leaving even experienced analysts and observers confused.