In the last week of 2024, as the new year begins, certain economic trends have emerged that may dominate in 2025. The US dollar maintained strong performance, with the Dollar Index (DXY) reaching its highest level in two years, surpassing 109.50, signaling its continued dominance in financial markets throughout the coming year.

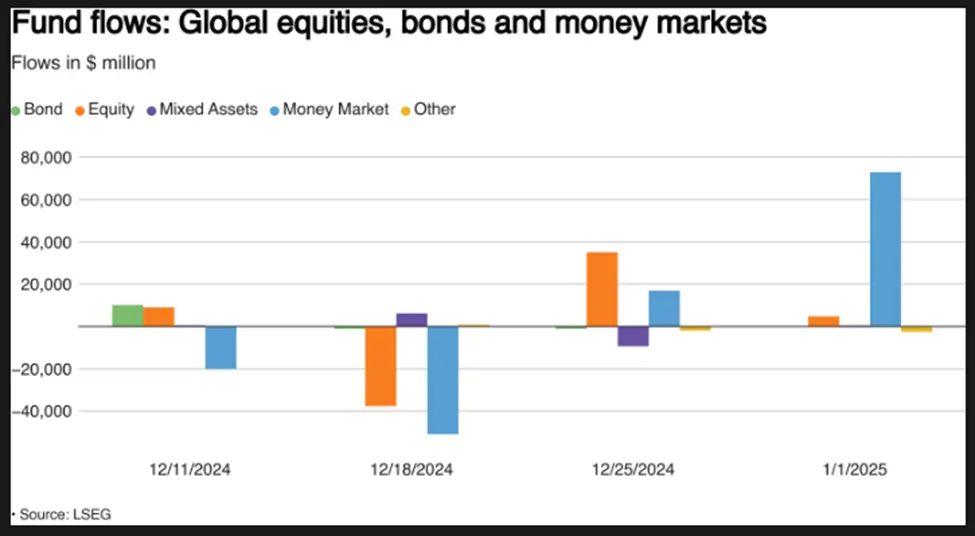

On the other hand, US stock markets declined, with the S&P 500 index dropping for five consecutive days after December 26. However, historical trends suggest that the first half of January is typically a positive period for US markets. In this context, investors added approximately $4.93 billion to global equity funds, a significant drop from the $35.1 billion added the previous week, reflecting concerns about rising bond yields and increasing chances of portfolio rebalancing.

Gold prices saw slight upward movement but remained within a narrow range, as investors continue to view gold as a safe haven amid economic uncertainties. Simultaneously, political factors, such as potential tariff impositions by Trump, could strengthen the dollar while maintaining gold’s appeal as a secure asset.

Oil prices rose by 4% after a period of stability, but analysts expect weak market prospects in 2025, forecasting oil prices around $70 per barrel due to declining inventories and unfavorable economic conditions.

In Asia, focus will shift to China’s services PMI, with expectations of limited growth data. The declining value of the yuan, which hit new lows against the dollar, suggests the possibility of new tariff implementations. Meanwhile, China’s manufacturing data showed slight improvement, though concerns about economic contraction remain.

In advanced markets, attention will turn to the US non-farm payroll report, with projections of 153,000 new jobs, a drop in the unemployment rate to 4.2%, and a 4% increase in wages. Following a series of interest rate cuts in 2024, markets are anticipating another 50 basis point cut in 2025.

In Europe, inflation data will take center stage, as the euro struggles against the dollar with predictions it may reach parity. Lower inflation could prompt the European Central Bank to lower interest rates, further widening the monetary policy gap between it and the US Federal Reserve.