Center Line : MA(CL, Period, Type)

Hi Band : Center Line + MA(True Range, Period, Type) * HiMultiplier

Lo Band : Center Line – MA(True Range, Period, Type) * LoMultiplier

True Range

TR = MAX{

1- ABS(HI1 – LO)

2- ABS(HI – CL1)

3- ABS(CL1 – LO)

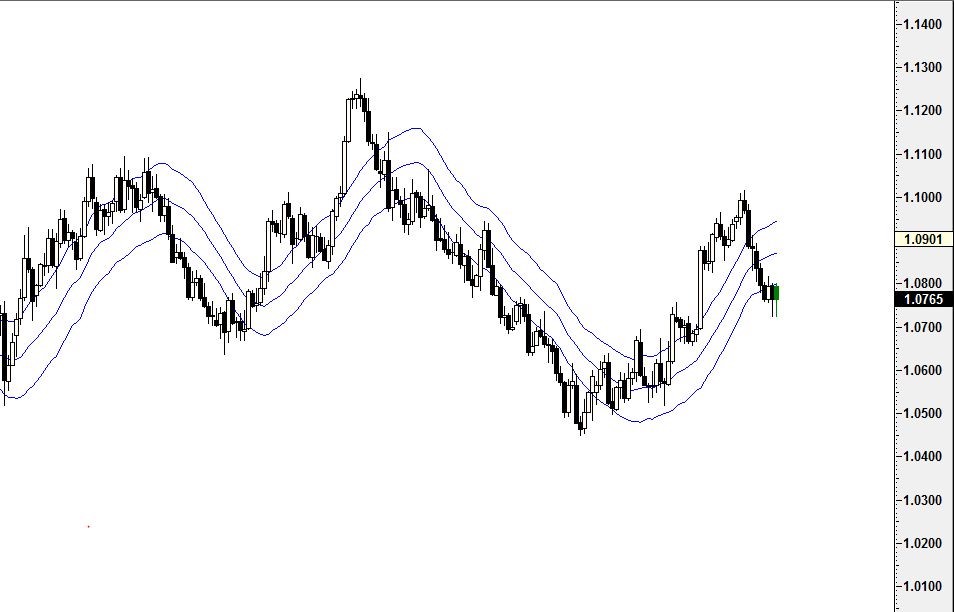

Above is a Daily Line Chart of an S&P 500 Future contract (SP`M) . The white line is the center line of the Keltner study, while the Blue lines represent the high and low bands, based on the preferences specified below.

The Preferences . . .

1- MA Type – Moving Average type, which is applied to both the true range, and the closing price in the calculation.

2- MA Period – Moving Average period, which is applied to both the true range, and the closing price in the calculation.

3- Center Line Color – Color of the Center Line.

4- Hi Band Color – Color of the High Band.

5- Lo Band Color – Color of the Low Band.