Implied volatility is : a key variable in most option pricing models, including the famous Black-Scholes Option Pricing Model.

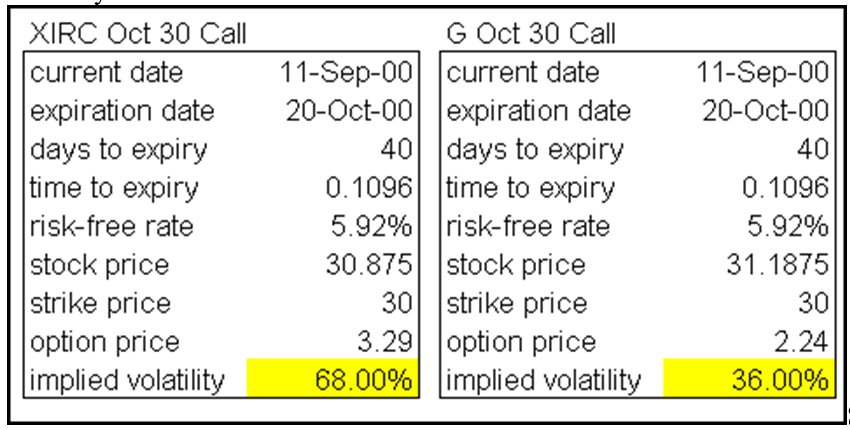

Other variables usually include : security price, strike price, risk-free rate of return and days to expiration. If all other variables are equal, the security with the highest volatility will have the highest option prices. Many Nasdaq and tech stocks (XIRC and AMGN) have higher volatilities than NYSE and non-tech stocks (G and MRK), and their options are also priced accordingly.

One method of measuring volatility is by finding the standard deviation of the underlying security. However, the standard deviation cannot always explain the volatility that is implied by an option’s price. Many times the price of an option will reflect more volatility than that measured by the standard deviation. This led to the notion of implied volatility, which is based on option prices. If the option price is known, then plugging in all variables and solving for volatility will yield the implied volatility.