Last week saw major market moves driven by U.S. elections and the Federal Reserve.

Equities: U.S. large-cap stocks hit all-time highs, with a 2.5% gain on last Wednesday marking the best day of 2024. Industrials surged on expectations of an “America First” agenda, while small caps rose 7.6%, boosted by growth prospects and fewer regulatory barriers.

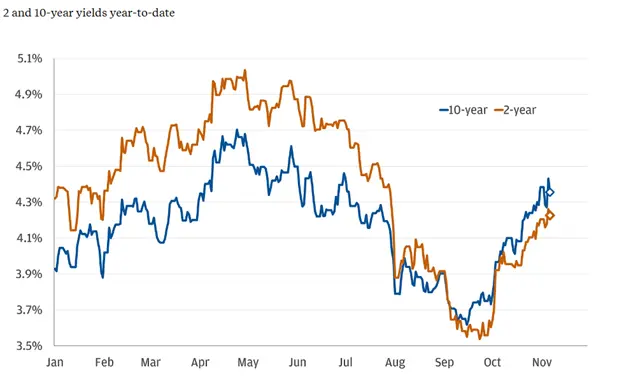

Fixed Income: Yields on the 2-year and 10-year Treasury notes rose after the election, but pulled back slightly. Higher inflation and fiscal deficits may drive future yield increases.

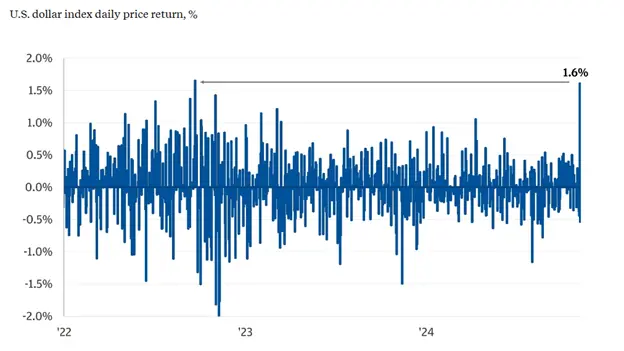

Currencies: The U.S. dollar saw its largest one-day gain in two years (+1.6%) but retreated slightly. A focus on onshoring (practice of bringing jobs and production back in the economy) and tariff threats helped support the dollar.

Commodities: Oil rebounded after a September drop, with OPEC+ delaying output increases. Gold pulled back (-1.6%) due to the dollar’s strength.

Crypto: Bitcoin hit new highs, reaching above $90,000 fueled by expectations of deregulation and institutional adoption.

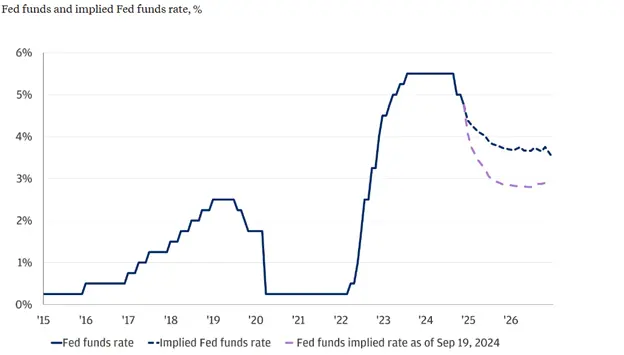

Fed Meeting: The Fed cut rates by 25 basis points to 4.5%-4.75%, signaling an ongoing easing cycle. Chair Powell emphasized that the election would not impact near-term policy.

Investor Outlook: Cash yields are lower, and it would be wiser to make neutral duration in portfolios. The bullish perspective sustained on U.S. equities, particularly in industrials, utilities, tech, and financials, with expectations for a “soft landing” for the economy.