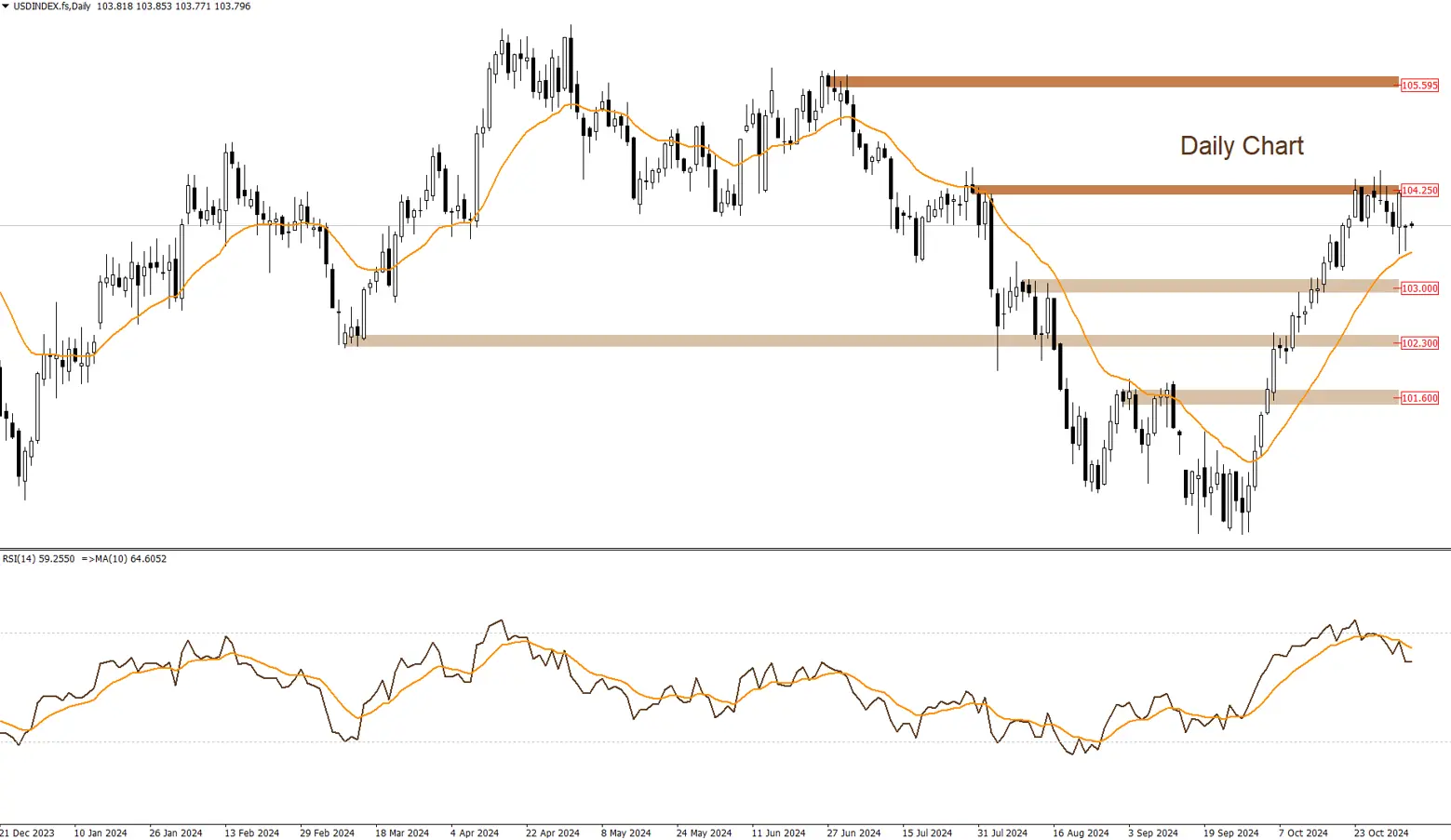

DOLLAR INDEX

The U.S. Dollar Index is trading below the 104.25 resistance zone, and prices are likely to move sideways between the aforementioned resistance zone and the 103 support zone.

|

Support |

103 | 102.30 | 101.60 |

| Resistance | 104.25 | 104.90 |

105.55 |