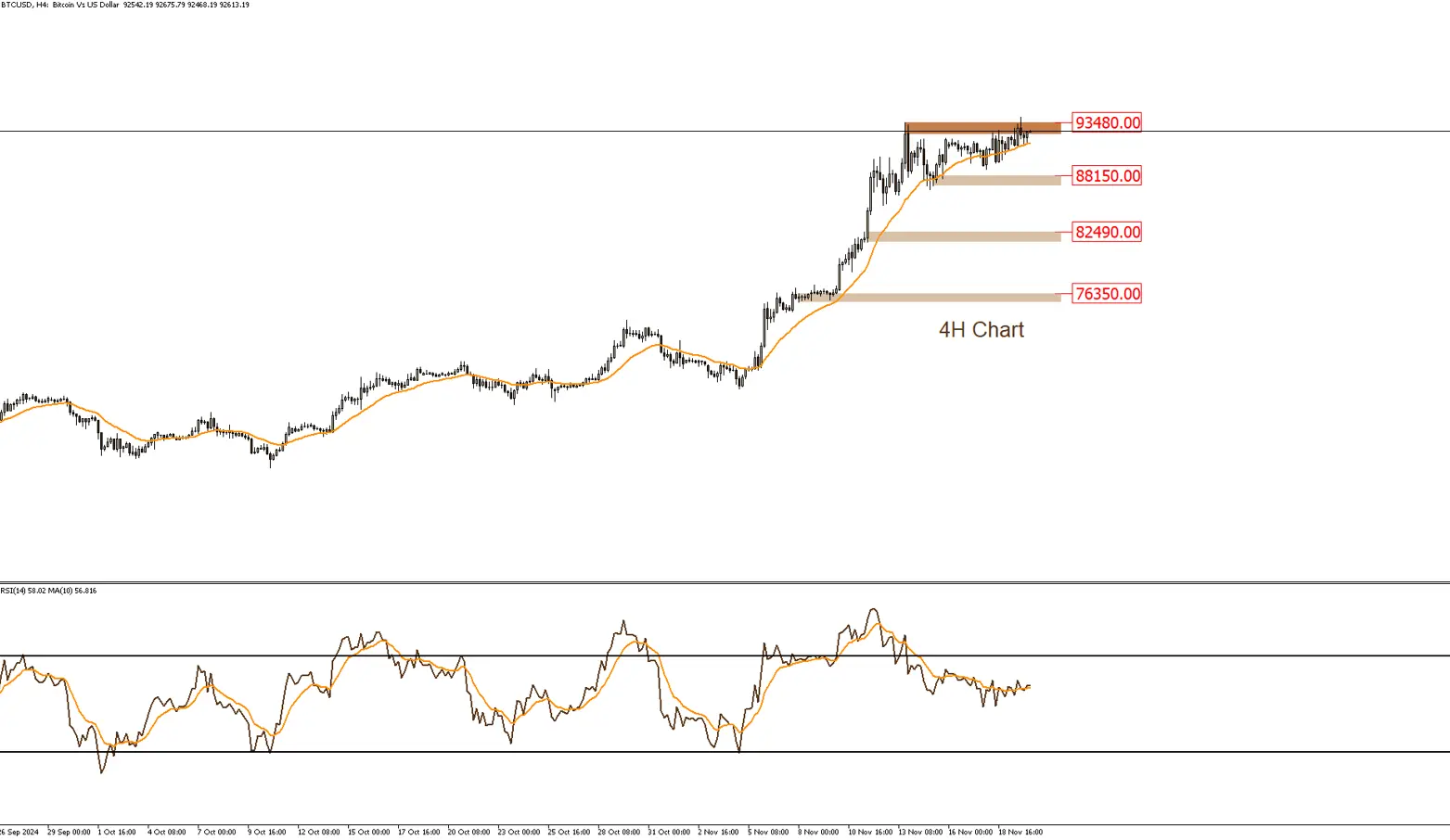

BTCUSD

Bitcoin is moving in an upward trend in the medium term, and prices are likely to break through the resistance level of $93,480. This scenario would be invalidated if the support level of $88,150 is breached.

|

Support |

88150 | 82490 | 76350 |

| Resistance | 93480 | 95000 |

100000 |