DOLLAR INDEX

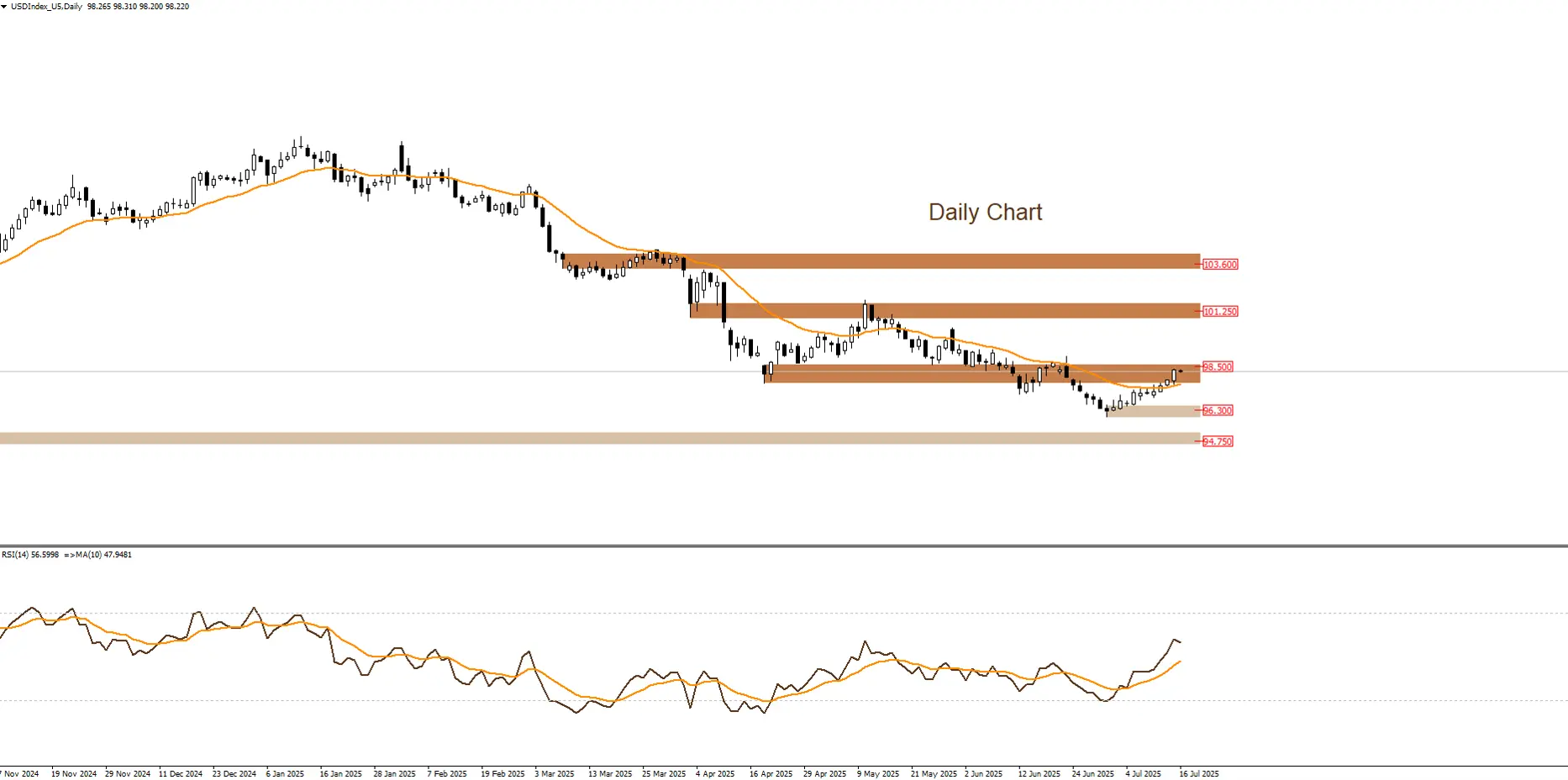

U.S. Dollar Index is trading around the resistance zone of $98.50, and this level is likely to limit the pace of the upward movement during today’s trading.

|

Support |

96.30 | 94.75 | – |

| Resistance | 98.50 | 101.25 |

103.60 |

The US Dollar Index (DXY) recorded a notable increase during today’s trading session, driven by strong US economic data and rising Treasury yields, which boosted investor appetite for the dollar as a safe haven asset.

This upward movement was supported by declining expectations of interest rate cuts by the Federal Reserve following strong US inflation data. Additionally, trade uncertainty particularly the impact of new tariffs has contributed to increased demand for the dollar. Markets have repriced the likelihood of rate cuts this year, which has directly influenced the currency’s performance. With new economic data expected next week, the dollar remains supported in the short term, while markets closely monitor any signals of changes in monetary policy or geopolitical tensions.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.