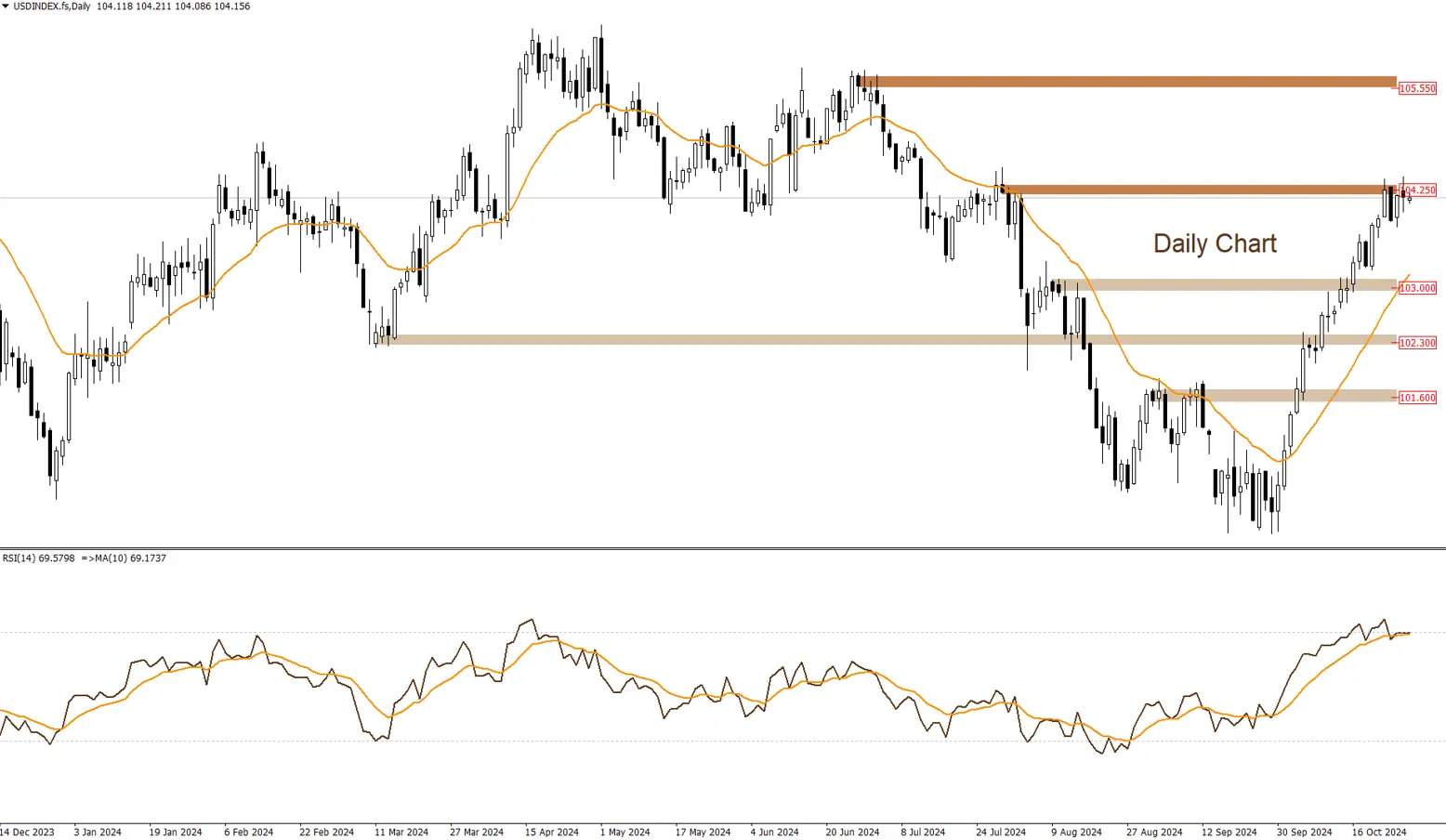

DOLLAR INDEX

The U.S. Dollar Index is trading around the resistance area of 104.25, and it is likely to break upwards. However, this scenario would be invalidated by breaking the minor support area of 103.75.

|

Support |

103.75 | 103 | 102.30 |

| Resistance | 104.25 | 104.90 |

105.55 |