I’m a Trader with 17 years of experience in the most of Financial Markets ( Equities, Commodities , Forex). I have worked on integrated campaigns for major clients such as Al Horria brokerage, Venus International and Admiral Markets.

Until recently, I Trade in Only the International Markets industry. In this role I was focused on Trading and Portfolio Managing .Successes included creating a social expert to mange the accounts of my clients automatically decisions.

Colleagues know me as a highly creative Trader who can always be trusted to come up with a new techniques . But I know that the client’s business comes first, and I never try to impose my ideas on others. Instead, I spend a lot of time understanding and collecting data about the several markets I can work well alone, but I’m at my best collaborating with others.

I have a PhD from AIN SHAMS University and a Cfte1 from the International Federation of Technical Analysts IFTA.

Prev Post

Next Post

REACH OUT TO US

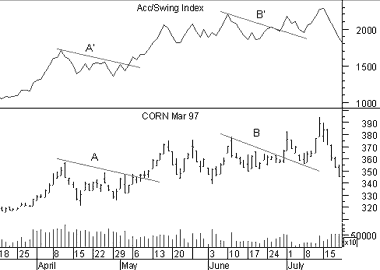

You can see that the breakouts of the price trendlines labeled “A” and “B” were confirmed by breakouts of the Accumulation Swing Index trendlines labeled “A'” and “B’.”

You can see that the breakouts of the price trendlines labeled “A” and “B” were confirmed by breakouts of the Accumulation Swing Index trendlines labeled “A'” and “B’.”