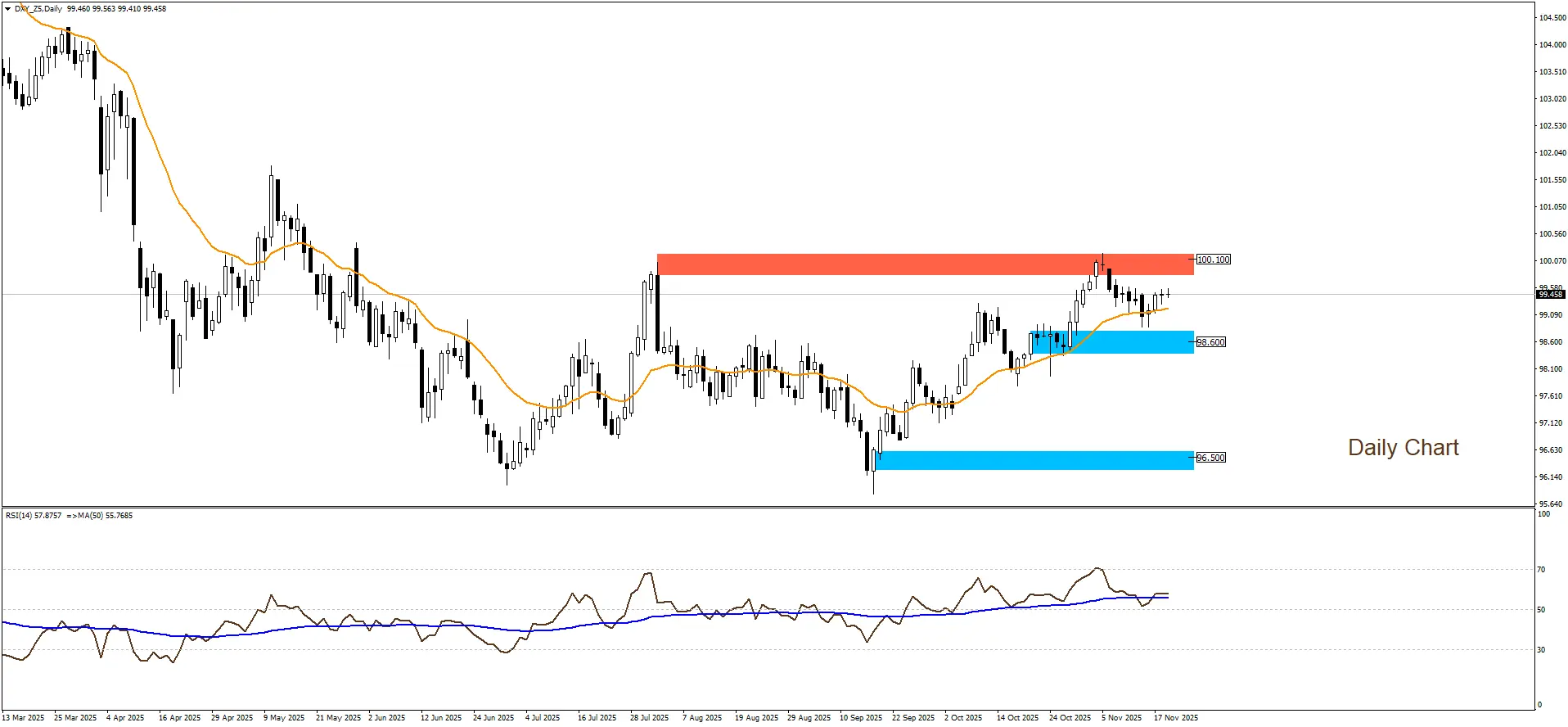

DOLLAR INDEX

U.S. Dollar Index is trading above the support level of $98.60, and prices are likely to move sideways between the resistance level at $100.10 and the aforementioned support level.

|

Support |

98.60 | 96.50 |

| Resistance | 100.10 |

101 |

The US Dollar Index extended its gains for the fourth consecutive session today, supported by rising US Treasury yields and growing expectations that monetary policy will remain on a cautious path in the coming period. This performance reflects stronger investor appetite for the dollar as a financial safe haven, amid the relatively hawkish tone from Federal Reserve officials and the absence of clear signals pointing to a rate cut in December. The dollar also benefited from broad selling pressure across major currencies following economic data that indicated a notable slowdown in several major economies, prompting traders to seek more stable assets. In the near term, market focus remains on upcoming US labor data and the Federal Reserve’s minutes, which will play a key role in determining whether the dollar can maintain its current bullish momentum.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.