Dollar declined as Donald Trump signed the agreement to end the longest government shutdown in U.S. history

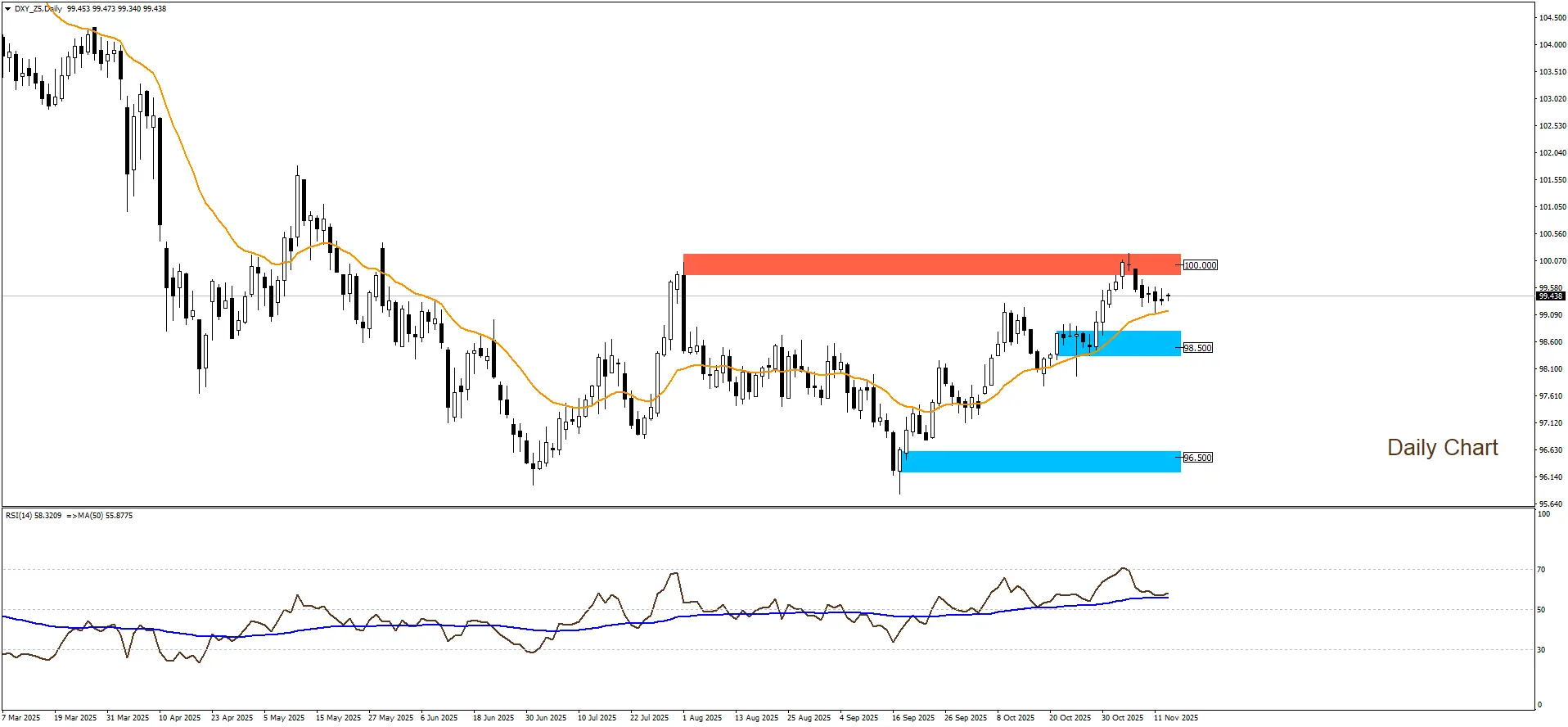

DOLLAR INDEX

U.S. Dollar Index is trading below the resistance level at $100, and prices are likely to retest the support level at $98.50. This scenario would be invalidated if the previously mentioned resistance level is broken to the upside.

|

Support |

98.50 | 96.50 |

| Resistance | 100 |

100.50 |

The U.S. dollar fell sharply today as pressure on the currency increased following economic data that came in weaker than expected, reviving speculation about a possible interest rate cut before the end of the year. With risk appetite improving in global markets after the U.S. government reopened, investors shifted toward higher-yielding assets, adding further downside pressure on the dollar. A decline in U.S. Treasury yields also reduced the dollar’s appeal during the session. Despite the drop, traders remain focused on upcoming inflation data, which could determine the currency’s direction in the weeks ahead.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.