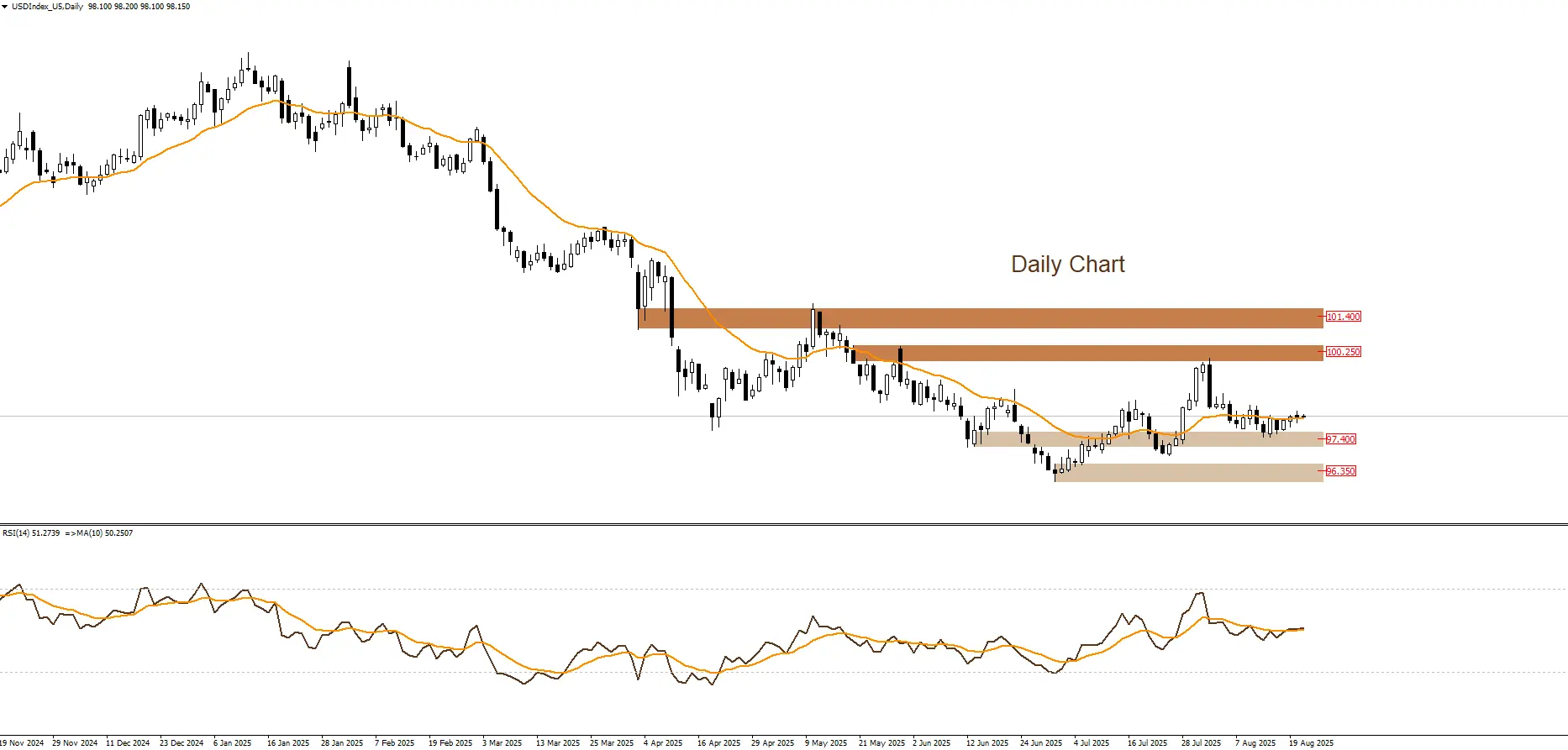

DOLLAR INDEX

U.S. Dollar Index is trading above the support zone at $97.40, and prices are likely to move sideways between the minor resistance level at $98.90 and the mentioned support level.

|

Support |

97.40 | 96.35 | – |

| Resistance | 98.90 | 100.25 |

101.40 |

The U.S. Dollar Index (DXY) closed with a slight gain of around 0.06% at 98.28, supported by stronger than expected inflation data (PPI), which reduced the likelihood of a rate cut in September.

Despite this limited advance, markets remain cautious, particularly amid political debates over the Federal Reserve’s independence following criticism from President Trump, which is weighing on investor confidence. Attention is now focused on Jerome Powell’s upcoming speech at the Jackson Hole Symposium, which could shape the outlook for monetary policy. Any signals of delaying or slowing the pace of rate cuts may provide further support for the dollar, while confirmation of an easing path could renew pressure on the index in the coming weeks.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.