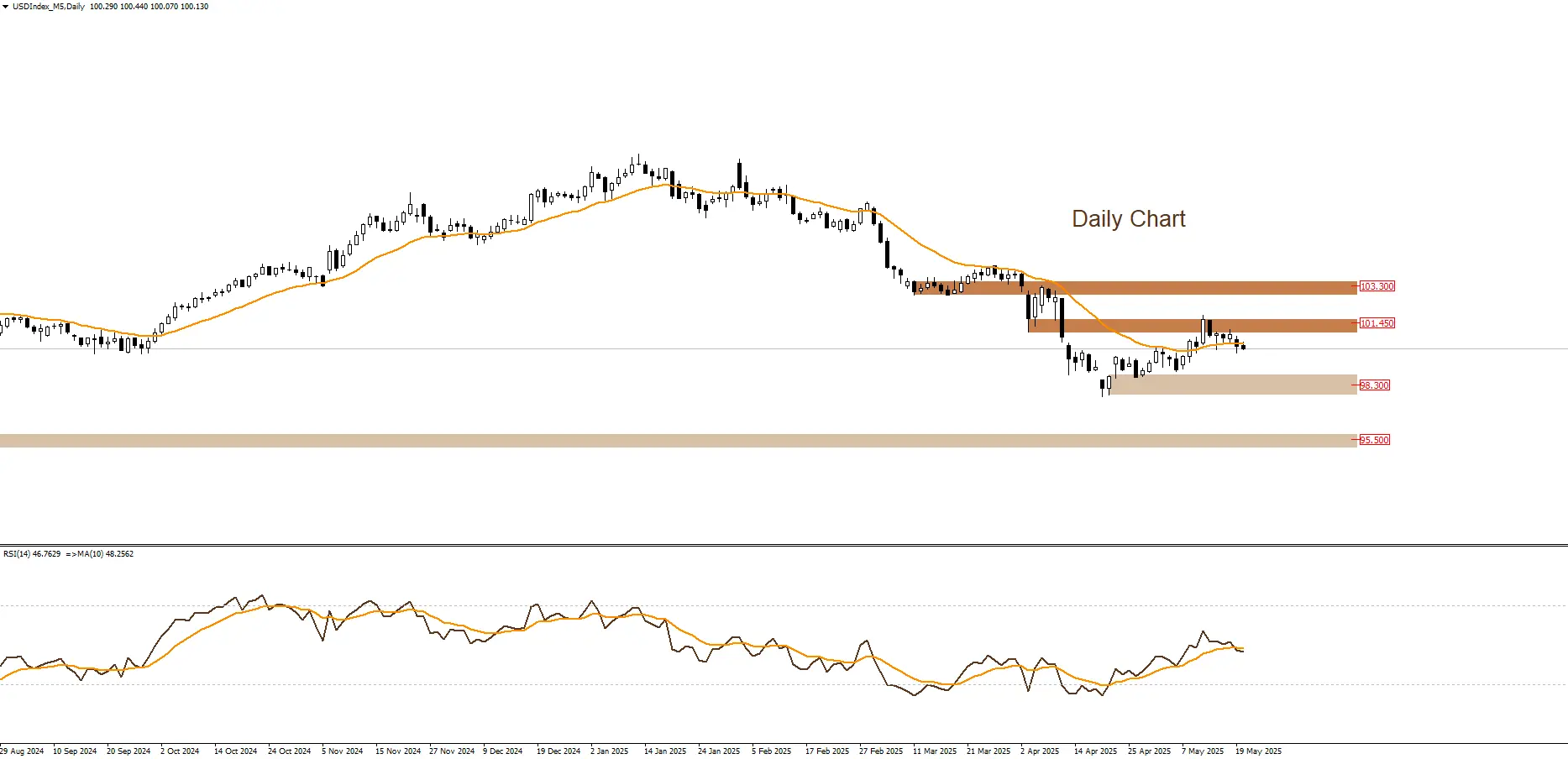

DOLLAR INDEX

The U.S. Dollar Index is trading below the resistance zone at 101.45, and prices are likely to decline and retest the support area at 98.30. This scenario would be invalidated if the aforementioned resistance zone is broken to the upside during today’s trading.

|

Support |

98.30 | 95.50 | – |

| Resistance | 101.45 | 103.30 |

– |

The US Dollar Index witnessed a notable decline during today’s trading session, recording daily losses of approximately 0.5%. This drop is attributed to several factors, most notably market expectations of potential interest rate cuts by the Federal Reserve, in addition to ongoing trade tensions, especially following the announcement by the US President of new tariffs on a range of imported goods.

Technical and economic indicators suggest that the US dollar is facing multiple challenges that could impact its performance in the short to medium term. Investors are advised to closely monitor upcoming economic data and Federal Reserve statements to determine the index’s future direction.

You can now benefit from LDN company’s services through the LDN Global Markets trading platform.