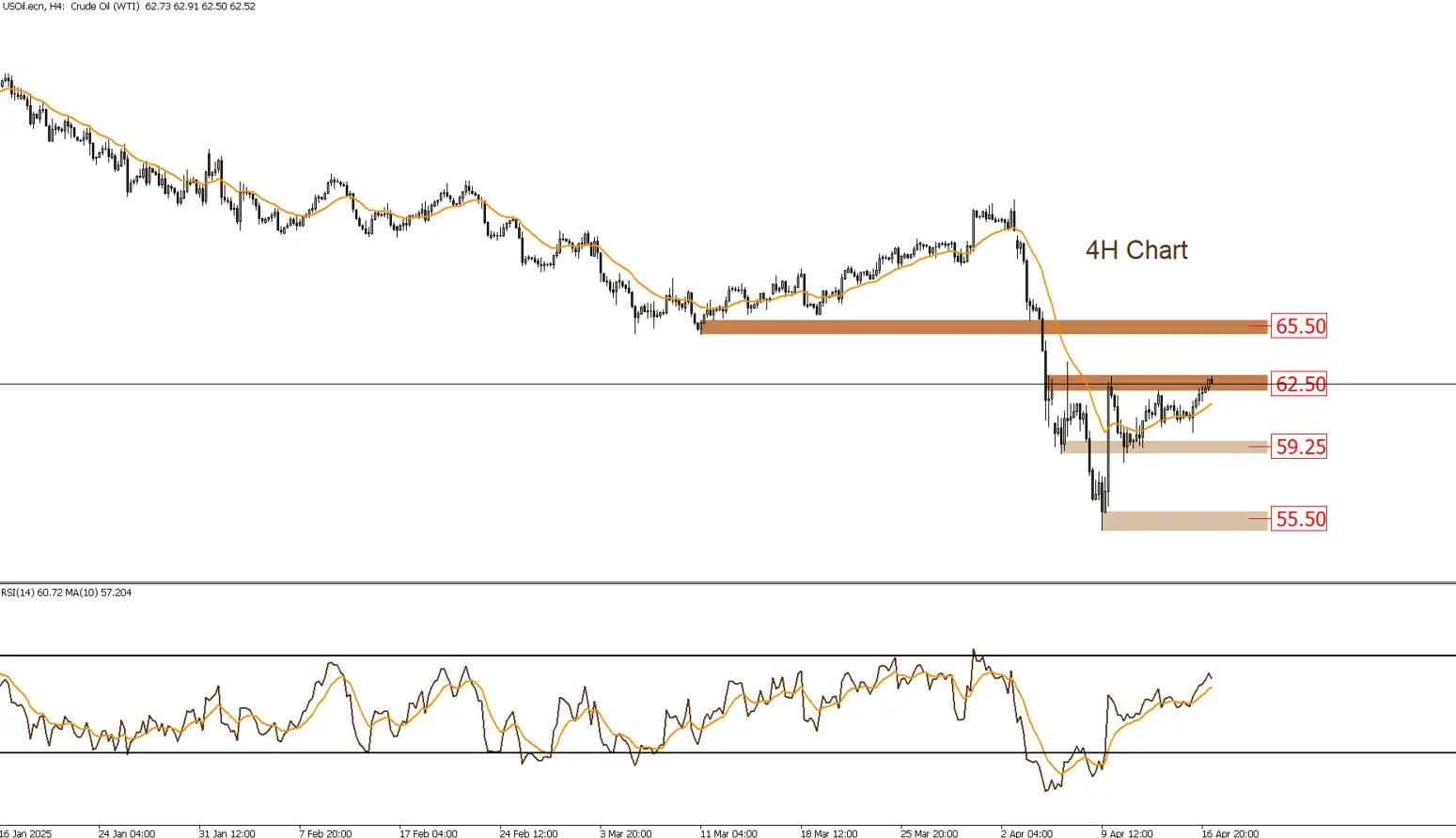

USOIL

Oil is trading around the resistance area of $62.50, and if it breaks above this level, we may target the $65.50 area. However, it is likely that the previously mentioned resistance area will limit the upward momentum in today’s trading.

|

Support |

59.25 | 57.50 | 55.50 |

| Resistance | 62.50 | 65.50 |

68.50 |