The NASDAQ index experienced significant declines during the opening session yesterday before rebounding, driven by the impact of DeepSeek on technology markets. Despite being a startup, DeepSeek has made a tangible impact on the global AI industry. One of its most notable achievements is the introduction of its R1 model, which offers capabilities similar to ChatGPT by OpenAI but at a fraction of the cost. The key to this cost efficiency lies in DeepSeek’s use of older and less expensive AI chips, enabling the development of its model at a cost of only $5.8 million. This is a stark contrast to the vast sums spent by major U.S. firms like Meta and OpenAI, which invest hundreds of millions or even billions of dollars in developing AI technologies. This cost advantage has given DeepSeek a clear competitive edge, significantly influencing global technology markets.

Liang Wenfeng, the founder of DeepSeek, established the company after graduating from Zhejiang University. Before launching his startup, he co-founded a quantitative hedge fund. Liang earned his bachelor’s degree in IT engineering from Zhejiang University in 2007 and a master’s degree in information and communication engineering in 2010. Throughout his career, he made significant strides, notably developing an algorithm for tracking targets using low-cost PTZ cameras during his research.

Liang later established Hangzhou Yakebi Investment in 2013, followed by Zhejiang Jiuzhang Asset Management in 2015. In 2019, he launched High Flyer AI, one of the first firms to integrate AI into trading strategies for market trend predictions and investment decision-making.

Founded in 2023, DeepSeek focuses on developing Artificial General Intelligence (AGI). It has quickly risen to prominence in China’s AI sector, providing innovative solutions leveraging deep learning and machine learning. These advancements have allowed companies to process vast amounts of data more efficiently and accurately.

In response to DeepSeek’s rapid ascent, technology stocks witnessed a sharp decline. NVIDIA, a leading AI chip manufacturer, suffered a staggering $500 billion loss in market value, reflecting the disruptive impact of DeepSeek on the industry.

From a technical analysis perspective, as long as prices remain below the $128–$130 resistance zone, we may see a continued downtrend toward the $100–$102 support level.

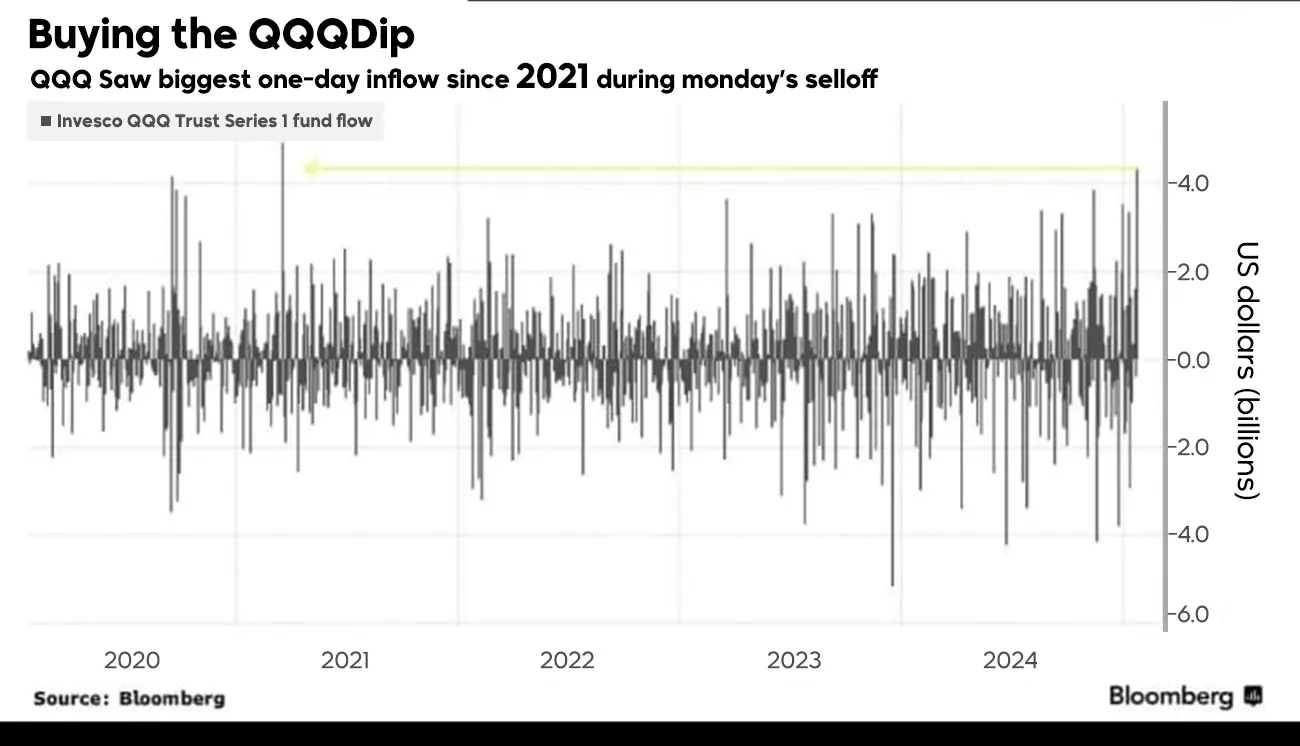

However, investors quickly bought the dip in tech stocks, with $4.3 billion flowing into the Invesco QQQ ETF, which tracks the Nasdaq-100 Index. This was the largest daily inflow since 2021. The QQQ ETF represents 100 of the largest non-financial companies listed on Nasdaq, heavily weighted toward the tech sector. This strong inflow suggests investor confidence in the long-term outlook of the technology industry, despite recent volatility.

While DeepSeek’s rise marks a potential shift in the global tech landscape, Chinese tech firms face significant geopolitical challenges. Many Chinese technology companies have been undervalued due to geopolitical risks, but DeepSeek’s success might alter this perception, increasing their global competitiveness. The U.S. government is already reviewing the national security implications of DeepSeek, highlighting potential regulatory risks.

Data privacy concerns are also emerging. Reports indicate that DeepSeek collects user data similar to TikTok, including device model, operating system, typing patterns, IP address, and system language. This has intensified privacy fears among Western regulators.

Elon Musk also commented on DeepSeek’s ability to bypass U.S. restrictions on advanced AI chip exports. In a post on X (formerly Twitter), Musk stated that DeepSeek possesses around 50,000 Nvidia H100 chips. Meanwhile, NVIDIA has affirmed that DeepSeek’s operations demonstrate the feasibility of developing AI models using available technology while complying with legal and regulatory constraints.

The geopolitical landscape continues to shift, with growing trade tensions between the U.S. and China. Former U.S. President Donald Trump recently announced new tariffs starting February 1, aimed at limiting China’s access to advanced technologies. These measures are expected to significantly impact Chinese firms like DeepSeek, which still rely on foreign technology.

Additionally, the U.S. Federal Reserve is set to hold its next meeting on January 29, 2025, where it is widely anticipated to keep interest rates unchanged. This decision could negatively impact stock markets, as investors may perceive it as a sign of continued economic pressure and limited growth stimulus. In turn, this could weaken market confidence and increase stock volatility.