For much of this year, US inflation has been on a steady decline, sparking hopes that rising prices would eventually lead to falling interest rates. However, as 2025 approaches, some areas of inflation are proving more persistent than anticipated, leading economists to question if this is the best we can expect.

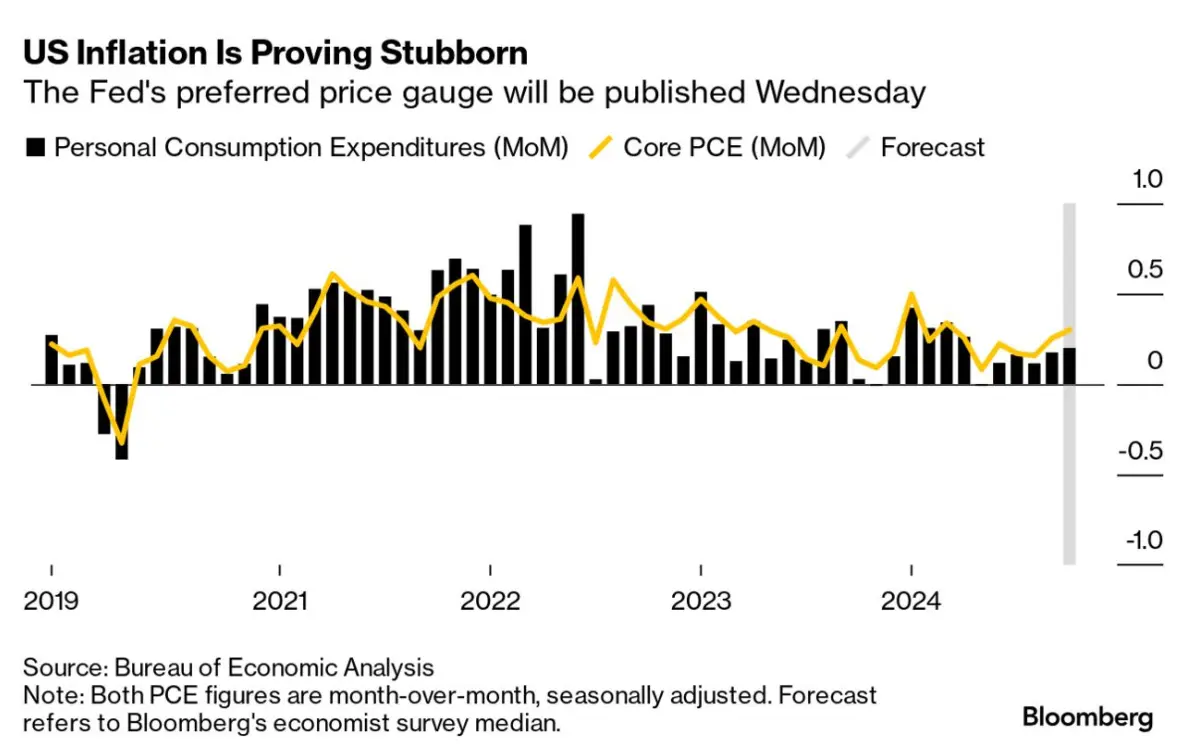

We’ll get a clearer picture of the situation when the Federal Reserve’s closely watched inflation gauge is updated on Wednesday. The Personal Consumption Expenditures (PCE) index is expected to show a 0.2% rise in October from the previous month and a 2.3% increase from a year ago.

The Fed monitors this index because it is seen as a more comprehensive measure of inflation than other metrics, capturing not just consumer spending but also indirect expenses, such as those incurred by third parties and the government. In fact, the PCE is often considered the Fed’s preferred inflation gauge because it reflects broader spending patterns and shifts in consumer behavior, making it a crucial tool for gauging the economy’s underlying price pressures.

If the reading aligns with expectations or comes in below them, it would reinforce the view that the disinflation trend remains largely intact, giving the Fed space to reduce rates at its mid-December meeting. This would bolster the idea that the central bank’s aggressive rate hikes earlier in the year are continuing to have the desired effect on inflation. However, a higher-than-expected reading could spark the opposite reaction, raising concerns that the Fed has less flexibility. This would signal that inflation is not yet under control, making it more difficult for policymakers to ease rates without risking a resurgence in prices.

This scenario would be particularly significant given president-elect Donald Trump’s pledge to impose broad tariffs on imported goods, which economists warn could put upward pressure on inflation by increasing the cost of foreign products. With a potential trade war looming, this would add another layer of uncertainty for the Fed, complicating their task as they navigate the delicate balance between inflation control and economic growth.

If policymakers at the Fed thought this year’s inflation story was complex, the challenges they face a year from now may be even more complicated. With a volatile geopolitical landscape, evolving consumer spending patterns, and the potential for new fiscal policies to influence price stability, the road ahead could be bumpy. The Fed’s ability to manage inflation, while avoiding unnecessary economic slowdowns, will be tested in the coming months as inflationary pressures remain a top concern.