Tesla’s stock surged nearly 15%, increasing the company’s market capitalization by $110 billion, bringing its total value to approximately $904 billion. Tesla is expected to benefit from Elon Musk’s close ties with Donald Trump, especially after Trump expressed intentions to establish a government efficiency commission, potentially led by Musk. Musk’s influence is anticipated to grow further due to his role as a major U.S. Department of Defense contractor through his ownership of Starlink and leadership at Tesla.

Meanwhile, shares of Tesla’s competitors, such as Lucid Group and Rivian Automotive, dropped by 5.3% and 8.3%, respectively, which helped Tesla solidify its position at the top. This advantage was further boosted by Trump’s pledge to impose significant tariffs on Chinese imports, including electric vehicles, potentially shielding Tesla from increased competition. Shares of China’s BYD also declined by 2.3% overnight, reinforcing Tesla’s dominance in the market.

Additionally, Trump’s pro-business stance and focus on boosting American manufacturing could create a more favorable environment for Tesla’s expansion, including potential tax incentives and reduced regulatory burdens compared to competitors. As Tesla continues to scale production and innovate with new technologies, the company stands to benefit from any potential reduction in international trade barriers or an increase in government contracts.

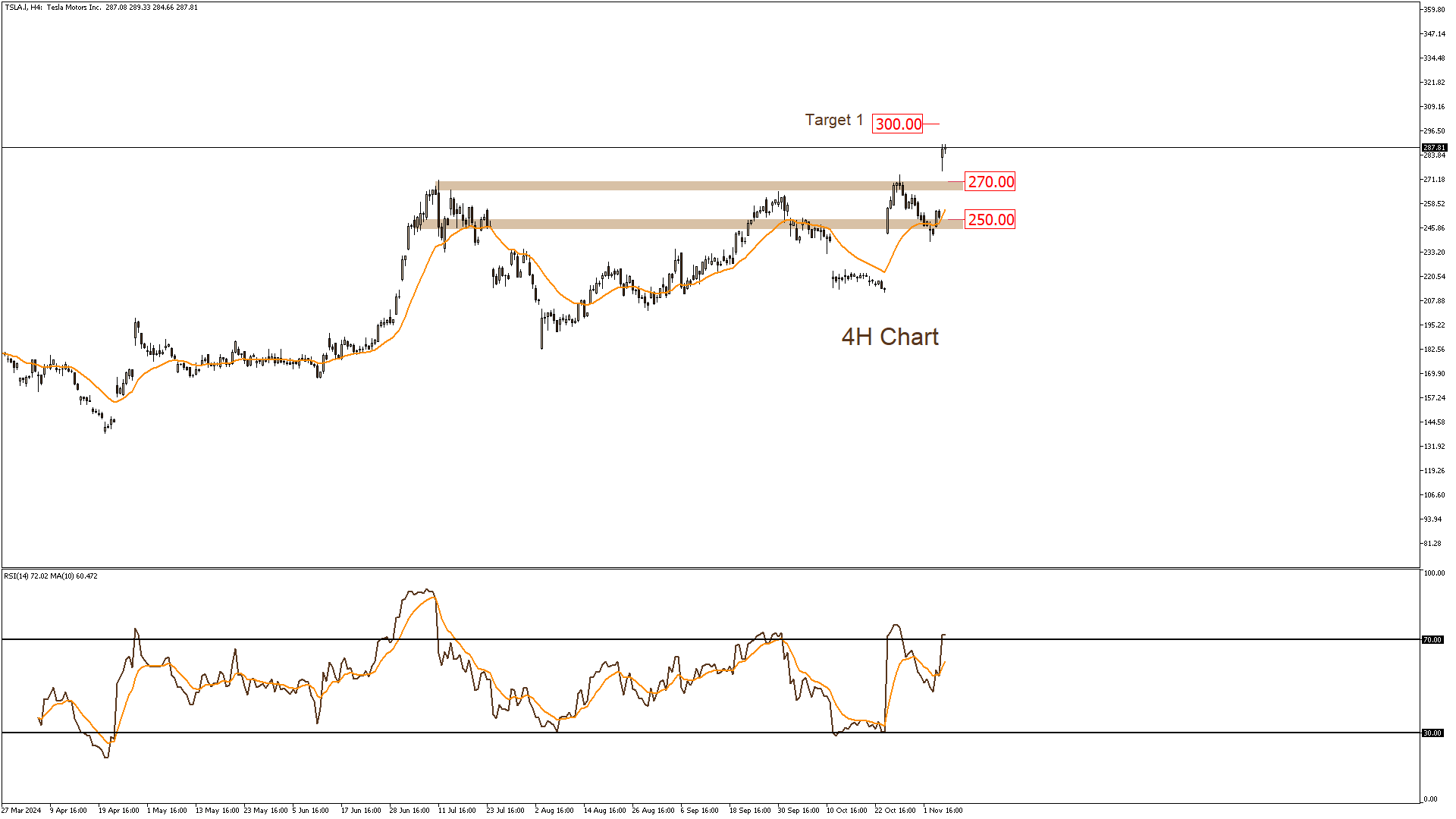

Tesla Stock Technical Analysis:

Tesla had been trading within a consolidation range, but after Trump’s win, the stock surged significantly. Key resistance levels are now near $300, while support is seen around the $270-$250 range. With the current upward trend, the stock is expected to maintain its momentum moving forward. Analysts are also watching the $300 level as the next major test for the stock, as continued optimism about Musk’s influence and government ties bolsters investor confidence.