Is the market can be irrational?

While markets are quite rational most of the time, there are times when the market loses its sense of reality.

Here are some examples of euphoria:

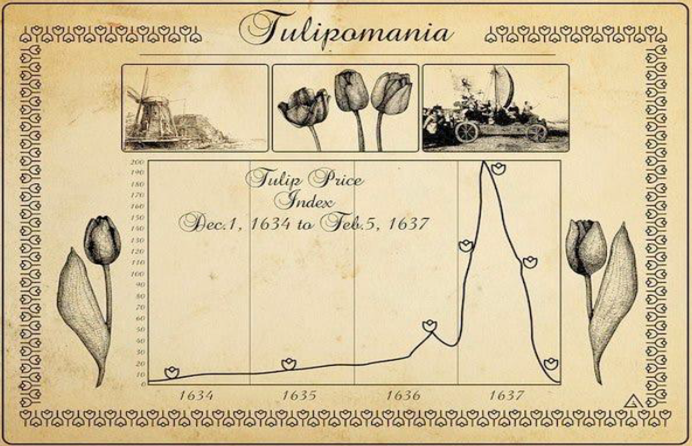

1- At the height of the Tulip Mania, tulips sold for approximately 10,000 guilders, equal to the value of a mansion on the Amsterdam Grand Canal.

2- In the 1980s, Japanese stock and urban land values tripled. The Nikkei Index traded at 60x earnings. The index had a negative return for the next 30 (!) years.

3- During the Dotcom Bubble, there were 457 (!) tech IPOs. By 2002, all investors together lost more than $5 trillion.

Here are some examples of extreme fear:

1- After the Great Depression (1929), most stocks were trading under their book value. A lot of stocks even traded under their liquidation value.

o Nobody wanted to own stocks these days and this was one of the best times to buy them. Over the next decade, American stocks returned 250%.

2- During the Financial Crisis, the S&P500 fell 56.8% from its peak.

o It seemed like the world would end during the financial crisis. Warren Buffett stated that this was the opportunity of a generation and the S&P500 has returned 563% since then in general, the best time to buy stocks is when there’s blood running through the streets.

The main reason why markets aren’t fully rational.

The main reasons why the stock market isn’t fully efficient? Humans are not rational at all.

1- 80% of drivers think they drive better than average.

2- 65% of Americans believe they are above average in intelligence.

Human irrationality creates periods of extreme fear and greed.

Rational investors can benefit from this. Do the following to take advantage of Mr. Market:

1- Define your financial goals and create a plan to achieve these goals.

2- Pick an investment strategy which matches your personal beliefs and stick to it rigorously.

o Make sure the strategy makes sense and has proven it’s success in the past.

o Here’s the Quality Investment Philosophy summarized: My Quality Investment Philosophy.

3- Keep learning and keep fine-tuning your strategy.

– “Despite the comfortable academic consensus of market efficiency, financial markets will never be efficient because markets are, and will always be, driven by human emotions: greed and fear.” – Seth Klarman