Overview : The Aroon indicator was developed by Tushar Chande. Aroon is Sanskrit word “dawn’s early light” or the change from night to day. The Aroon indicator allows you to anticipate changes in security prices from trending to trading range. For more information on the Aroon indicator see the article written by Tushar Chande in the September 1995 issue of Technical Analysis of Stocks and Commodities.

These changes are anticipated by measuring the number of periods that have passed since the most recent x-period high and x-period low. Therefore, the Aroon indicator consists of two plots; one measuring the number of periods since the most recent x-period high (Aroon Up) and the other measuring the number of periods since the most recent x-period low (Aroon Down). The actual plotted value is a “stochastic” like scale (see Stochastic Oscillator) ranging from 0 to 100. Assuming a default time-period of 14 days, if a security makes a new 14-day high, the Aroon Up = 100; when the security makes a new 14-day low, the Aroon Down = 100. When the security has not made a new high for 14 days, the Aroon Down = 0; when the security has not made a new low for 14 days, the Aroon Down = 0.

The age-old problem for many trading systems is their inability to determine if a trending or trading range market is at hand. Trend-following indicators such as MACD and moving averages, tend to be whipsawed as markets enter a non-trending congestion phase. On the other hand, overbought/oversold oscillators (which work well during trading range markets) tend to overreact to price pull-backs during trending markets—thereby closing a position prematurely. The Aroon indicator attempts to remedy this by helping you determine when trend-following or overbought/oversold indicators are likely to succeed.

Aroon Indicator is one of the new indicators of Metastock 6.0 or later versions .The Formula of Aroon Indicator consists of several complex formulas as follows :

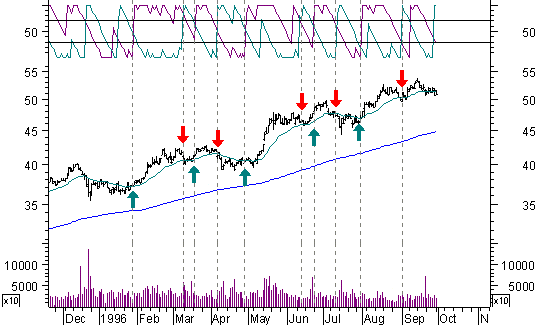

Interpretation : There are basically three conditions that you look for when interpreting the Aroon indicator: extremes at 0 and 100, parallel movement between Aroon Up and Aroon Down, and crossovers between Aroon Up and Aroon Down.

Extremes : When the Aroon Up line reaches 100, strength is indicated. If the Aroon Up remains persistently between 70 and 100 a new uptrend is indicated. Likewise if the Aroon Down line reaches 0, potential weakness is indicated. If the Aroon Down remains persistently between 0 and 30 a new downtrend is indicated. A strong uptrend is indicated when the Aroon Up line persistently remains between 70 and 100 while the Aroon Down line persistently remains between 0 and 30. Likewise a strong downtrend is indicated when the Aroon Down line persistently remains between 70 and 100 while the Aroon Up line persistently remains between 0 and 30.

Parallel Movement : When the Aroon Up and Aroon Down Lines move parallel with each other (are roughly at the same level), then consolidation is indicated. Expect further consolidation until a directional move is indicated by an extreme level or a crossover.

Crossovers : When the Aroon Down line crosses above the Aroon Up line, potential weakness is indicated. Expect prices to begin trending lower. When the Aroon Up line crosses above the Aroon Down line, potential strength is indicated. Expect prices to begin trending higher.

Interpretation Conclusion : Chande states that when Aroon(up) and Aroon(down) are moving lower in close proximity, it signals a consolidation phase is under way and no strong trend is evident. When Aroon(up) dips below 50, it indicates that the current trend has lost its upwards momentum. Similarly, when Aroon(down) dips below 50, the current downtrend has lost its momentum. Values above 70 indicate a strong trend in the same direction as the Aroon (up or down) is under way. Values below 30 indicate that a strong trend in the opposite direction is underway.

The Aroon Oscillator signals an upward trend is underway when it is above zero and a downward trend is underway when it falls below zero. The farther away the oscillator is from the zero line, the stronger the trend.