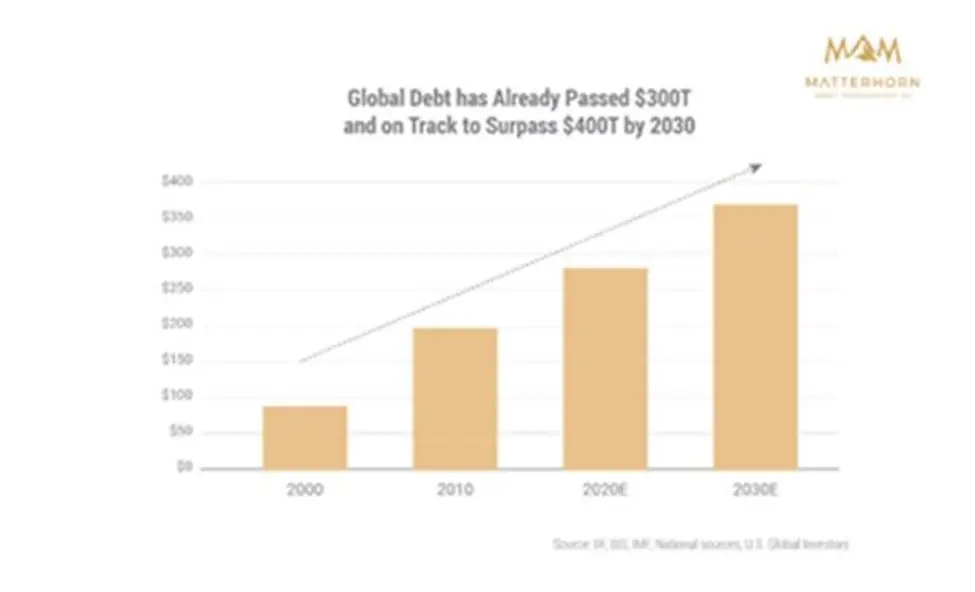

At the beginning of 2025, many analysts predict a significant decline in the US dollar, while gold prices are expected to rise substantially. This scenario seems increasingly likely with the growing US national debt, which has now exceeded $37 trillion, up from $34 trillion last year. This continuous rise in debt is part of a broader trend in the global bond market, now valued at over $130 trillion.

History teaches us that countries burdened with heavy debts often face economic crises and frequently resort to devaluing their currency as a means to address these challenges. While such a move harms bondholders and savers, it strengthens the value of gold, which typically shines during times of currency weakness.

The US Federal Reserve is considered the primary entity responsible for maintaining stability in the bond market, even if it requires printing more money to purchase bonds and keep interest rates low. Although this policy aims to shield the government from the severe consequences of its mounting debt, it comes at the cost of a weaker dollar, as inflation erodes individual wealth. Consequently, the dollar is expected to weaken further in 2025 as the United States grapples with its debt crisis. Conversely, gold is likely to continue its strong performance as a tangible asset that investors turn to in such times.

The administration of former President Donald Trump supported the idea of a weaker dollar, reflecting the reality that nations often devalue their currencies to protect their debt markets. Given the ongoing rise in military spending and debt, the dollar’s decline is likely to persist in the near future. Therefore, a weaker dollar appears to be the most realistic solution to potential economic challenges. If the dollar remains strong, it could lead to slower economic growth and higher deficits, making a weaker dollar the more logical choice in the end. Regardless of who is in power, historical facts and economic data strongly suggest that the dollar is on a downward trajectory, while gold prices are set to continue their ascent.